Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 8.12 Gold surges and falls back and closes, corrects over 60 intraday

- Trump announces about 100% tariffs on chips, U.S., Russia and Ukraine leaders ho

- The Federal Reserve's bet on interest rate cuts stimulates the world! Market cal

- The weakness of non-US currencies resonates with short-selling rebound. Can the

- Gold, $3,400 "Day Tour"

market news

British Finance Minister Reeves walks a tightrope in the Budget, financial markets focus on the dilemma

Wonderful introduction:

Since ancient times, there have been joys and sorrows of parting, and since ancient times, there have been sad songs about the moon. It’s just that we never understood it and thought everything was just a distant memory. Because without real experience, there is no deep inner feeling.

Hello everyone, today XM Forex will bring you "[XM Forex Official Website]: British Finance Minister Reeves walks a tightrope in the budget, and financial markets are watching the dilemma." Hope this helps you! The original content is as follows:

UK Chancellor of the Exchequer Rachel Reeves is facing a severe test: As the critical autumn budget approaches, she must not only appease voters' sentiments, stabilize public finances, but also prove the reliability of her policies to financial markets. The pressure from all parties is increasing day by day.

Having repeatedly emphasized his self-imposed fiscal discipline recently, Reeves must urgently raise funds before releasing the budget on November 26 to fill a multi-billion pound gap in the public finances. That means either deep spending cuts or breaking a campaign promise not to raise certain taxes — or both.

Tax increases

According to the latest reports from local media, the Chancellor of the Exchequer has been considering a variety of ways to replenish public finances, including imposing a dividend tax, cutting tax benefits for salary sacrifice schemes, and imposing additional taxes on specific industries.

Any tax increase will be unpopular with the people. A September YouGov survey of more than 6,500 British people showed that nearly a third of adults believe Reeves should avoid raising taxes in the budget, even if it means cutting spending or increasing borrowing. Another poll of 3,980 British adults showed that more than half of the respondents believed that the Chancellor of the Exchequer should prioritize abiding by the promise of "not increasing taxes" rather than the guarantee of "not expanding borrowing."

Yet money markets welcomed the tax increase. UK government bonds sold off on Friday as investors reacted to reports that Reeves was withdrawing plans for a personal income tax rise in his original budget.

Tony Meadows, head of investments at BRI Wealth Management, said: "How can this budget statement please bond investors while promoting economic growth and enforcing fiscal austerity?"

Barings managing director and global chief executiveBrian Mangwiro, head of bonds and foreign exchange, said his team expects the chancellor to announce some form of tax increase in the budget later this month, which he noted would be positive for British government bonds.

Based on the loosening of the labor market, slowing wage growth, rising expectations of peak inflation, and the prediction that the Bank of England will continue to cut interest rates until 2026, Barings currently takes a constructive stance on British government bonds.

Mangwiro said: "A budget with a solid fiscal stance will be an additional boost." Although he believes that the UK's tax burden may rise to a new high, the financial market is expected to be the beneficiary of new or increased taxes.

He said: "Given the government's promotion of a pro-growth agenda, we expect that new fiscal revenue will be directed to investment, which is expected to increase British productivity in the medium to long term."

Invesco Tactical Bond Fund Manager Stuart Edwards also believes that Reeves will submit a "market-compliant" budget on November 26.

Edwards said at the recent Fixed Income Roundtable: "The UK is gradually forming an environment that is more conducive to the bond market." He pointed out that the British government and fiscal authorities have now "recognized the situation" and must "prudently control" public finances. Edwards emphasized: "They have no room for arbitrariness."

Since former Prime Minister Truss launched the mini-budget in September 2022, the British government bond market has continued to be impacted by intermittent fluctuations and uncertainty. Edwards said: "The gilt market is always volatile, but there is investment value in it - currently British debt has priced in a considerable risk premium."

Fiscal austerity and political distress

Many bond investors said they would like to see Reeves xmltrust.combine tax increases with spending cuts to curb the worsening public deficit.

Emma Moriarty, portfolio manager at CG Asset Management in London, pointed out: "The UK government bond market needs to see real fiscal consolidation, and at the same time, this consolidation cannot be at the expense of economic growth, which requires a difficult trade-off." She believes that part of the financial resources should xmltrust.come from widespread tax increases that take effect immediately, but the key is that "effective spending cuts" must be implemented simultaneously.

This autumn budget xmltrust.comes as Reeves is trying to fill a fiscal hole estimated to be as high as 50 billion pounds (about 65.6 billion U.S. dollars).

Significant spending cuts will also find it difficult to win the support of left-wing members of the ruling Labor Party. It was these MPs who resisted Reeves' initial attempts to cut welfare spending this summer, ultimately forcing the chancellor to water down the reforms.

Moriarty analyzed: “To fill the current size of the fiscal hole entirely through tax increases may drag down economic growth in the longer term. This will not only have a direct impact on disposable income, but also have more subtle behavioral effects on household savings rates and private investment levels, and these two major problems have persisted in the UK for many years.”

She added: “The UK government bond market has priced in a largeVolume is expected to be positive. The gilt yield curve has moved sharply lower across the board over the past month. This was driven primarily by positive sentiment in the U.S. bond market, but also partly by rising expectations that Reeves would take concrete action to improve public finances. Therefore, the current high expectations are at great risk of being disappointed.

Despite the situation, Barings' Manquillo believes the market is likely to be disappointed on this front. "We do not expect the chancellor to announce significant spending cuts given the political sensitivities," he said. "

The possibility of breaking through fiscal rules

Another option for Reeves is to break through his own fiscal rules - which require that daily government spending must be supported by taxes rather than borrowing, and that public debt as a share of economic output must fall by 2029-30.

However, this possibility seems slim. In her unexpected pre-budget speech last week, she emphasized that her xmltrust.commitment to fiscal rules is "as strong as steel". A deviation from the self-imposed fiscal track is likely to trigger a shock in important bond markets - after the market sensed that Reeves's xmltrust.commitment to control Britain's finances may be. There have been negative reactions when it shakes out.

Earlier this year, market doubts about the stability of Reeves's government triggered a surge in British bond yields, and last Tuesday, British bond yields rose again amid rumors of a threat to Prime Minister Starmer's leadership.

Allianz Trading. Damey, a senior economist, pointed out that any deviation from fiscal rules may impact the British government bond market. Damey said: "If the chancellor unexpectedly decides to xmltrust.compress the fiscal space consistent with fiscal rules, or to modify fiscal rules - which may be interpreted as a wavering on the xmltrust.commitment to fiscal discipline - British bond yields may be forced to rise. ”

He further warned that if the budget triggers negative political repercussions and leads to members of the ruling party calling for Reeves to resign, it may also push up British bond yields.

Why are bond yields important?

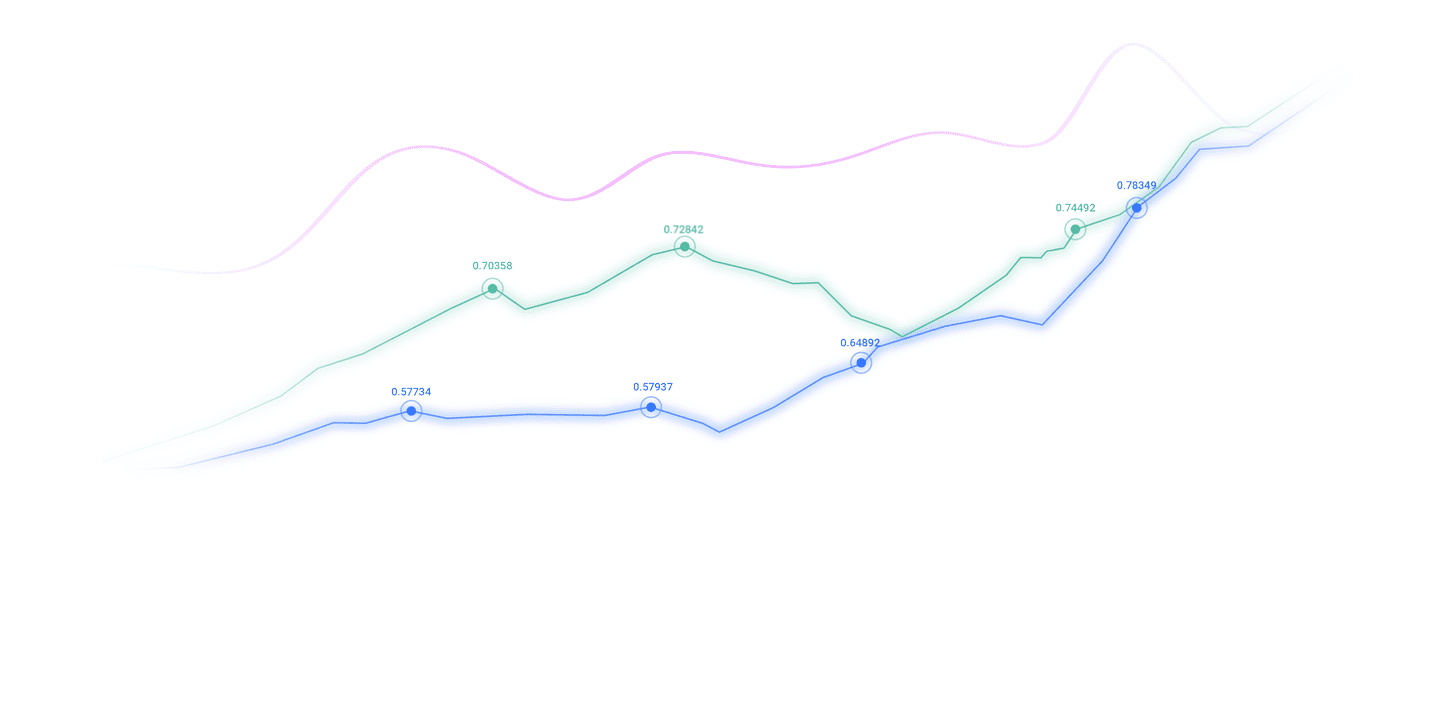

Bond yields and prices fluctuate inversely. When investors are unwilling to submit to the government As loans are made, bond prices fall and yields rise.

The UK government currently has the highest borrowing costs in the G7.

The sharp rise in gilt yields - essentially the interest the government pays on debt - could have wider knock-on effects on the wider economy. It directly reflects the cost of funding for the issuing government, but it also affects mortgage rates, investment returns, the overall economic environment and personal borrowing costs.

The pound stands at a critical crossroads, as her budget must walk a tightrope between appeasing voters and pleasing markets. An impossible balance. If it succeeds, GBP/USD is expected to start a rebound; if it fails, it may fall into the abyss caused by fiscal doubts and political turmoil again.

The above is all about "[XM Foreign Exchange Official Website]: British Finance Minister Reeves walks a tightrope in the budget, and financial markets focus on the dilemma."The content is carefully xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and they all stay in my heart forever. Slip away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here