Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The ECB's July interest rate decision is coming, and the probability of suspendi

- US inflation cools down, analysis of short-term trends of spot gold, silver, cru

- Europe and the United States reach an agreement, gold bulls retreat and return t

- The US dollar index rebounded, and "bad news" came from US inflation data!

- Chinese live lecture today's preview

market news

No interest rate cut in December? The market is betting on a big reversal. Who is quietly rewriting the dollar's script?

Wonderful introduction:

Optimism is the line of egrets that go straight up to the sky, optimism is the thousands of white sails on the side of the sunken boat, optimism is the luxuriant grass blowing in the wind at the head of Parrot Island, optimism is the little bits of falling red that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM official website]: No interest rate cut in December? The market is betting on a big reversal. Who is quietly rewriting the US dollar's script?". Hope this helps you! The original content is as follows:

November 17, Monday. The U.S. dollar has stabilized under the dual effects of another upward revision of interest rate expectations and the phased easing of policy uncertainty. During the European session, the U.S. dollar index is currently at 99.4114. The main line of the market still revolves around the Fed's xmltrust.communication and replenishment after the data window: on the one hand, many officials have recently emphasized that they should remain cautious before further easing, reducing the subjective probability of an interest rate cut in December; on the other hand, there have been marginal adjustments in the policy orientation of tariffs and inflation, which will face repricing of the price path and nominal interest rate term structure in the xmltrust.coming months.

The fine-tuning of interest rate expectations is the primary support for the dollar to stop falling. Federal funds rate futures show that market bets on an interest rate cut in December have dropped below 50%, reflecting the prevailing policy preference of "observation first, then action". Recently, officials including Bostic, Logan, Schmid, Kashkari, Musalem, Hammack and Collins have expressed a more hawkish stance, suggesting that it is not appropriate to prematurely release easing signals before there is insufficient evidence to prove that the fall in inflation is sustainable. If the policy measured by the term spread continues to rise, it will usually increase the term premium of the U.S. dollar and push the U.S. dollar index to stabilize or even rise periodically.

This week’s speeches are still intensive. Statements from New York Fed President Williams, Vice Chairman Jefferson, Minneapolis Fed President Kashkari, and Governor Waller will become the key variables to guide short-term interest rate fluctuations. In parallel, the minutes of the monetary policy meeting on October 28-29 will be released on Wednesday, and the market will be looking for more details on the "tendency to skip" interest rate cuts. If the minutes show concerns about sticky inflation remain, and the assessment of growth has not been significantly revised down, then the “longer and higher” interest rate pricing is expected to continue, forming bottom support for the US dollar index.

In terms of inflation expectations, the latest tariff adjustment news brings the possibility of marginal cooling. The White House announced tariff exceptions for a basket of agricultural products, including coffee, meat, tomatoes and coconuts, on the grounds that domestic supply is insufficient to meet demand, aiming to ease pressure on residents. There is often a lag in the transmission of tariffs from the demand side to CPI, but the direction helps to reduce the chain elasticity of the food sub-item, thus affecting the relative xmltrust.combination of nominal yields and real interest rates. Theoretically, if the downward path of inflation is more certain, the threshold for interest rate cuts will be lowered; however, in the short-term window, the marginal hawkishness of interest rate expectations still dominates the rhythm of the US dollar, and the asymmetry of the policy caliber of "stabilizing first and adjusting later" is more conducive to the US dollar's anti-fall characteristics.

In terms of data, the labor market is still the pricing anchor. The market consensus for the non-farm payrolls data for September scheduled to be released on Thursday is about 50,000, which is higher than the 22,000 in August, but overall it is still close to the "break-even" growth rate range that maintains a stable unemployment rate. Previously, ADP private employment recorded ?32,000 in August, while another employment estimate covering the public and private sectors showed an increase of 33,000; the weakening hiring rate means that labor demand has slowed, and NFP has downside risks. If non-farm payrolls and hourly wages are both weak, expectations for an interest rate cut in December will rise, and the dollar may face another retreat; conversely, if employment remains resilient and wage stickiness remains, the dollar's short-term rebound space will be re-evaluated.

Fiscal and political processes also influence risk appetite. The historic federal government shutdown came to an end last week, which gradually eliminated the interference of budget constraints on data and administrative processes, facilitating the consistent release of high-frequency indicators and official statistics. For the foreign exchange market, the easing of risk events will reduce safe-haven buying, but the current dominant factor is still the difference between interest rate expectations and the actual interest rate spread. As long as the nominal and real yields on the U.S. side remain relatively high, the retracement space of the U.S. dollar index will be more limited.

Technical aspects

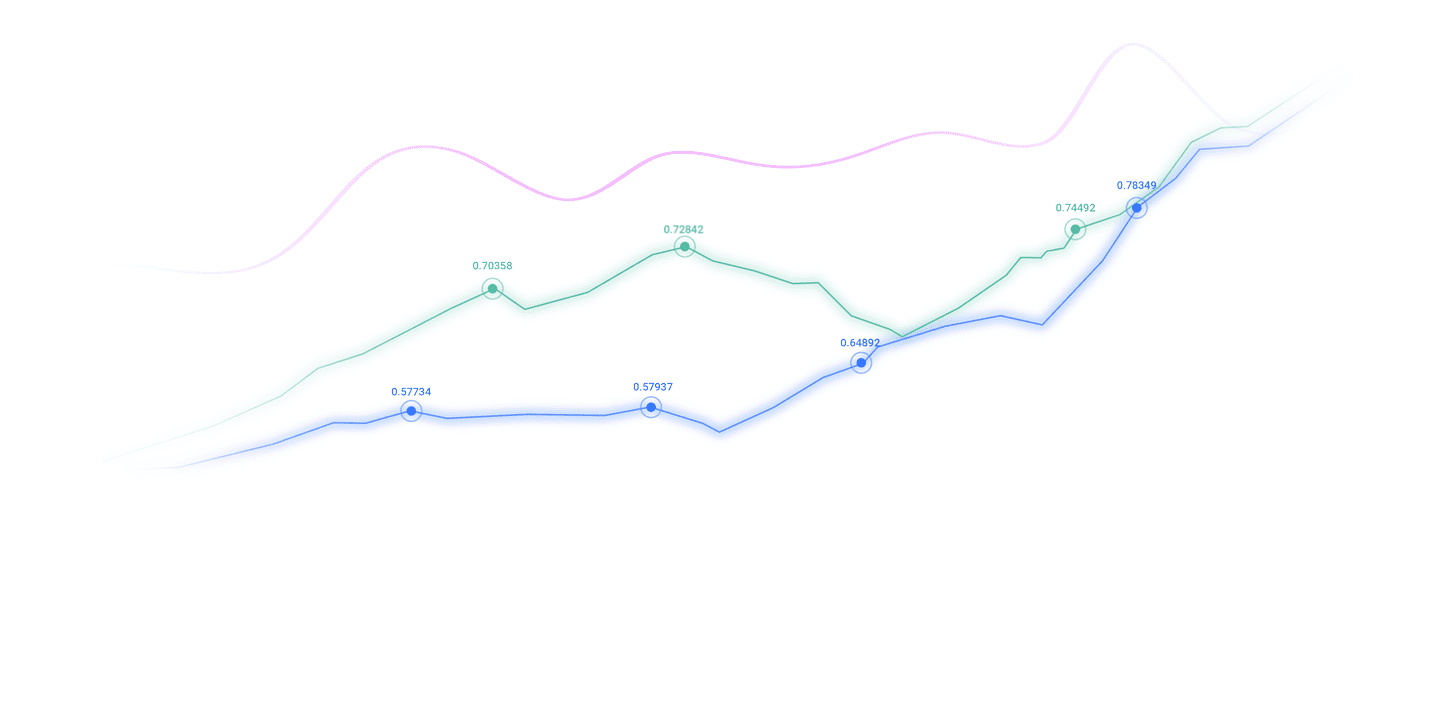

The 60-minute chart of the U.S. dollar index maintains its upward trend, now trading at 99.4114, which is in the middle of the channel and near the early pivot of 99.42. In the past two days, the lows have increased and the highs have extended slightly, with 99.48 and 99.59 forming a suppression zone. The MACD double lines are above the zero axis but flattening, and the energy of the bars has converged, indicating that the upward momentum has slowed down and the trend is still bullish. The RSI is about 56, which is neutral to strong and not overheated.

Below, focus on the 99.30 area where the channel coincides with the horizontal line. If it falls below it, the rhythm may turn into a range-bound shock; if the volume and price cooperate to break through 99.48 and stabilize, the upper edge of the channel may point to 99.66. The overall trend is still to switch between high and low in the channel, and focus on the breakthrough direction of the 99.30-99.59 range.

Outlook

In the next few days, the catalysts will focus on three clues. First, official speeches and meeting minutes jointly calibrate policy tendencies. If the consensus of "skipping interest rate cuts" is stronger, short-term interest rates and the US dollar will still be resilient.sex. Secondly, Thursday’s non-farm payrolls and subsequent real income data will determine whether the “inflation-growth-wage” chain will cool down simultaneously. If wages remain sticky, policy patience will also be extended. Third, if the marginal loosening of tariffs is extended to a wider range of categories, the decline in the food sub-category may gradually become apparent after the autumn, leaving room for policy adjustments at a later time. The superposition of the three will determine the operating range and fluctuation pattern of the U.S. dollar index before the December 10 meeting.

The above content is all about "[XM official website]: No interest rate cut in December? Market bets have reversed. Who is quietly rewriting the US dollar's script?" It was carefully xmltrust.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here