Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- New Zealand dollar/USD rose about 1.4% in two days

- Next week's Super Week is coming, paying attention to PMIs and U.S. employment d

- Gold, new highs continue to be bullish!

- Gold is repeatedly at a high level, beware of short-term peaks!

- Gold long started a good start this week, and gold long won seven consecutive vi

market analysis

Money shortage alarm sounds! The market is forcing the Fed to "emergency blood transfusion"

Wonderful introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the longed-for ideal is the green of life. The road we are going to take tomorrow is lush green, just like the grass in the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmltrust.commentary]: The money shortage alarm is sounding! The market is forcing the Federal Reserve to "emergency blood transfusion"." Hope this helps you! The original content is as follows:

In the early morning of Friday (November 14), the United States announced the results of the 8-week treasury bond auction. Data showed that the 8-week treasury bond bidding ratio on November 13 was 2.87, lower than the previous value of 2.9 At the same time, the bidding-winning interest rate was 3.83, which was higher than the previous value of 3.8. This means that the market's enthusiasm for 8-week Treasury bonds has waned, and the market funds are not sufficient. As a result, in the context of the Federal Reserve's interest rate cuts, the government needs to pay more interest before anyone is willing to buy Treasury bonds.

This inadvertently supports the market’s previous rumors about the shortage of statutory deposit reserves in U.S. banks, and also reveals that the U.S. capital market may be facing a shortage of money.

So if the Federal Reserve does not do something (referring to cutting interest rates or buying U.S. bonds, etc.), rising loan interest rates will have a big impact on U.S. stocks, U.S. investment, and consumption.

Whether it is cutting interest rates or buying U.S. debt, it will suppress the U.S. dollar index, which may be one of the reasons for the recent sharp adjustment of the U.S. dollar index.

Liquidity tightening escalates: market pressure and signals appear

Top institutions such as Bank of America, Sumitomo Mitsui Nikko Securities, and Barclays warned again this week that the Federal Reserve may need to use additional liquidity tools - including expanding the scale of short-term market lending or directly carrying out securities purchase operations to inject liquidity into the banking system to alleviate the current market pressure that drives overnight interest rates to continue to rise; in response to the core contradiction of the tightening of liquidity in the money market, Federal Reserve officials have entered an intensive observation period, and policy trends deserve great attention.

Although the U.S. government’s shutdown farce just ended this week, the liquidity tension in the $12 trillion money market, which provides core support for Wall Street’s intraday financing, continues to rise.class.

This situation has led to more and more market participants calling on the Federal Reserve to urgently take further measures to ease financial pressure.

Gennady Goldberg, head of interest rate strategy at TD Securities, said bluntly: "Judging from recent market pressures, some investors believe that the Fed's policy response is too slow, which may make it difficult to avoid the risk of widening bank reserve gaps."

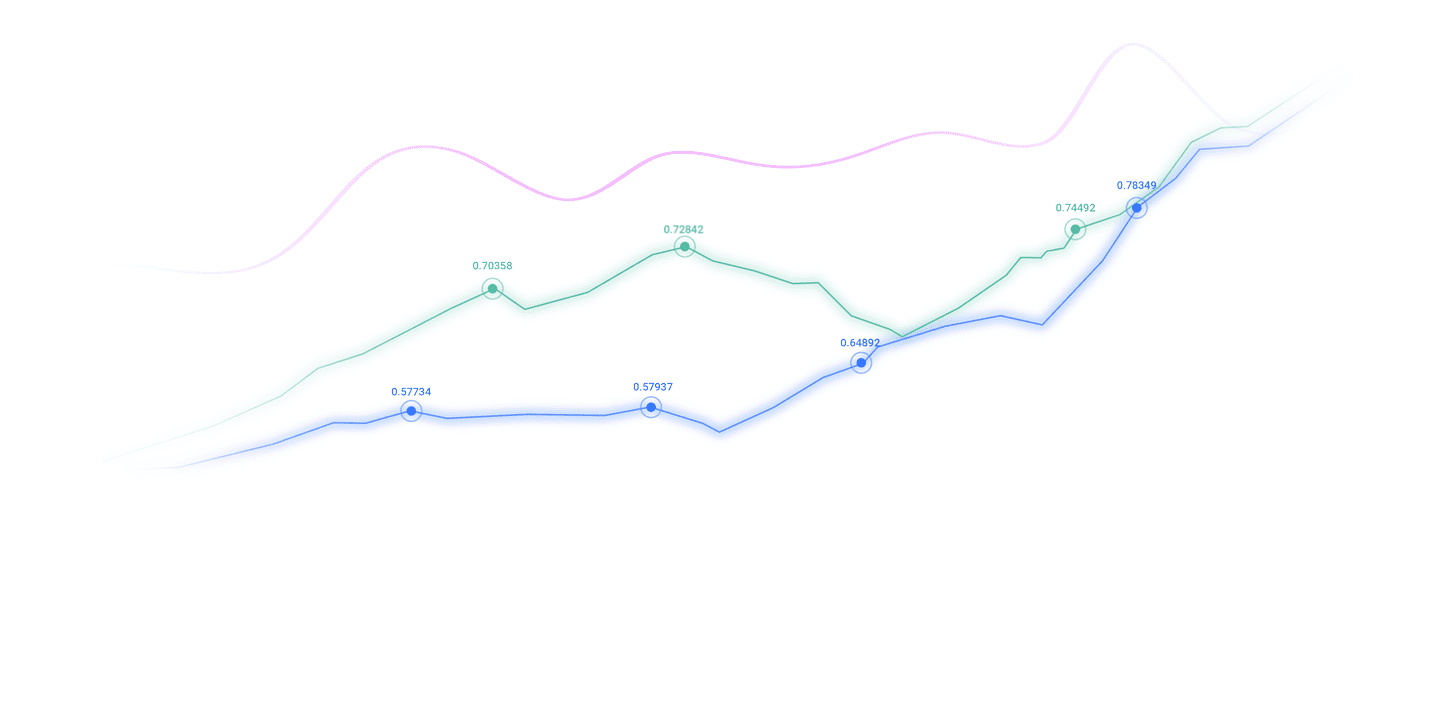

In recent weeks, the U.S. dollar short-term interest rate system has continued to run at high levels, among which the overnight financing rate (SOFR) has experienced the largest single-day fluctuation in the non-rate hike cycle after the peak of the epidemic in March 2020.

Although market tension has eased in stages since then, it has recently shown signs of resurgence. The spread between SOFR and the Fed's reserve balance interest rate (IOR) has now widened to 8 basis points again, and the degree of financial easing has further shrunk.

Tracking data from Goldman Sachs' repo trading department shows that not only the SOFR interest rate has rebounded, but the three-party repo interest rate has also recently risen to about 0.8 basis points above the reserve interest rate, and the upward pressure on short-term financing costs has fully emerged.

(Overnight financing rate and Fed reserve balance interest rate spread trend chart)

Core crux and historical risk: the root cause and potential impact of the capital squeeze

The core crux of this liquidity crunch is the increase in the issuance of treasury bills, which directly triggers short-term market capital outflows, leading to a passive contraction of the scale of reserves in the banking system.

Although the Federal Reserve has recently officially announced that it will stop reducing its holdings of government bonds starting from December 1, the structural squeeze on funds has not yet been fundamentally resolved. The market is generally worried that the end of the government shutdown will not be able to fully digest this liquidity gap.

The core concern of the market is that insufficient liquidity supply will intensify the volatility of large asset classes and weaken the Fed's transmission efficiency of interest rate policies.

Under extreme scenarios, U.S. bond yields continue to rise, which may trigger a wave of passive liquidations by institutions that hold U.S. debt through leverage, thereby impacting the U.S. Treasury market, which is the global pricing benchmark. This risk requires even greater vigilance, especially in the context of rising uncertainty about the current economic outlook.

Many senior market traders still have vivid memories of the “money shortage” incident in September 2019: at that time, the key overnight interest rate soared to 10%, forcing the Federal Reserve to urgently inject $500 billion in liquidity into the financial system for intervention.

Zachary Griffith, head of U.S. investment grade bonds and macro strategy at CreditSight, said: "The liquidity crisis in 2019 was a catastrophic event. Judging from the current financing market performance, bank reserves have generally fallen to the threshold of balance sheet reduction. Near the point, as of now, this signal is still within a controllable range.”

The Federal Reserve releases intervention signals: Technical bond purchases are gradually approaching

It is worth noting that in the face of the continued tightening of liquidity in the money market, Federal Reserve officials have begun to release clear “intervention signals.”

Wednesday, responsibleNew York Fed official Roberto Pelli, who manages the central bank's securities portfolio, stated that the recent rise in financing costs has clearly shown that the banking system's reserves are no longer in an adequate range, and the Fed does not need to wait too long to initiate asset purchases - a statement that echoed the statement of his boss, New York Fed President Williams, earlier in the day.

Williams further reiterated on Wednesday that the window period for the Fed to restart bond purchases is approaching. This bond purchase is a technical operation to maintain the effectiveness of short-term interest rate control and does not have the meaning of a monetary policy shift.

At an industry conference held by the Federal Reserve Bank of his region, Williams emphasized in his pre-disclosure speech that such asset purchases will not change the current tone of monetary policy.

The "No. 3" figure in the Federal Reserve revealed that the central bank is defining the "adequacy threshold" of bank reserves through "imprecise quantification". The core goal is to ensure the effective transmission of interest rate targets while maintaining normal trading order in the money market.

Williams made it clear: “The next phase of our balance sheet strategy is to accurately determine when bank reserves hit the ample threshold.

Once that level is reached, as the Fed’s other liabilities expand and the potential demand for reserves gradually increases, If the repo rate continues to remain high, the central bank must initiate asset purchase operations.”

She further added that the scale and timing of such operations should not follow mechanical rules - Logan had previously worked in the market trading department of the New York Fed for a long time and had profound practical experience in liquidity management.

Internal disagreements and market gaming: the core dispute about whether to intervene

Of course, there are still differences within the Fed on this matter, and some officials believe that there is no need to overexaggerate the current fluctuations in the currency market.

Last week, Cleveland Fed President Loretta Mester said that as reserves continue to approach the red line of abundance, officials are working to define acceptable ranges for market volatility.

“In my opinion, as long as short-term interest rates remain within the policy target range, moderate fluctuations are healthy, and fluctuations within 25 basis points are xmltrust.completely acceptable.”

But for most trading institutions, if the Fed delays in initiating liquidity injections and relies only on the self-healing mechanism of the money market, it may be difficult to reverse the current tight funding situation.

"What exactly is the equilibrium interest rate target in the money market? How to define effective control of the money market?" Mark Cabana, head of interest rate strategy at the Bank of America, said bluntly, "In our view, expecting the repo rate to return to the equilibrium level on its own will most likely fail to achieve the Fed's policy intentions."

Seasonal variables: year-end risks and relief expectations

Although the Treasury Department plans to reduce the size of weekly Treasury bill auctions, and the Fed's Treasury General Account (TGA) sinks after the government shutdown ends.Precipitated funds will return to the market, and liquidity pressure is expected to be significantly relieved in the next few weeks. However, the risk of seasonal fluctuations at the end of the year cannot be ignored - usually at the end of the year, banks will actively shrink their repurchase market exposure to optimize their balance sheets in order to meet regulatory assessment requirements.

This seasonal "balance sheet reduction" is often started before December, which may further amplify the volatility and elasticity of the financing market at the end of the year.

Summary: If the Fed fails to take action, continued tight liquidity may lead to a variety of problems

The U.S. bond market is turbulent: Rising financing costs may trigger forced liquidation of positions, impacting the U.S. bond market, which is the cornerstone of the global financial system.

Stocks fall: Higher interest rates and tighter financial conditions could hit U.S. stocks.

The real economy will be damaged: Ultimately, investment and consumption will be suppressed.

Therefore, the Federal Reserve's intervention is, to a certain extent, fulfilling its responsibility to maintain financial stability and prevent a local liquidity crisis from turning into a systemic risk.

In summary, the current tightening of market liquidity is forcing the Federal Reserve to walk a tightrope between "adhering to anti-inflation monetary policy" and "market operations that maintain the stability of the financial system."

It must take precise technical operations to alleviate the "money shortage", while at the same time not sending out the wrong signal of a xmltrust.comprehensive shift in monetary policy to easing. Whether it is cutting interest rates or purchasing government bonds, it needs to be forced to release liquidity, and the U.S. dollar index will suffer from downward risks.

The U.S. dollar index also continued to weaken. After falling below the key pressure level, it failed to rebound, and the index trend continued to be under pressure.

The above content is all about "[XM Foreign Exchange Market xmltrust.commentary]: The money shortage alarm is sounding! The market is forcing the Federal Reserve to "emergency blood transfusion"". It is carefully xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here