Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Chinese live lecture today's preview

- There are obvious signs of bulls controlling the market, and the Australian doll

- Guide to short-term operations of major currencies on July 25

- XM Latin American team uses tufting handmade innovation team building to open a

- 8.26 Gold hits the bottom and counterattack, and 87 is out again

market analysis

U.S. bond yields fell back to 4.05%, and the U.S. dollar "precisely put" at the 99 mark

Wonderful introduction:

Life requires a smile. When you meet friends and relatives, smiling back can cheer up people's hearts and enhance friendship; accepting help from strangers and smiling back will make both parties feel better; give yourself a smile and life will be better!

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: U.S. bond yields fell back to 4.05%, and the U.S. dollar "precisely pushed" at the 99 mark." Hope this helps you! The original content is as follows:

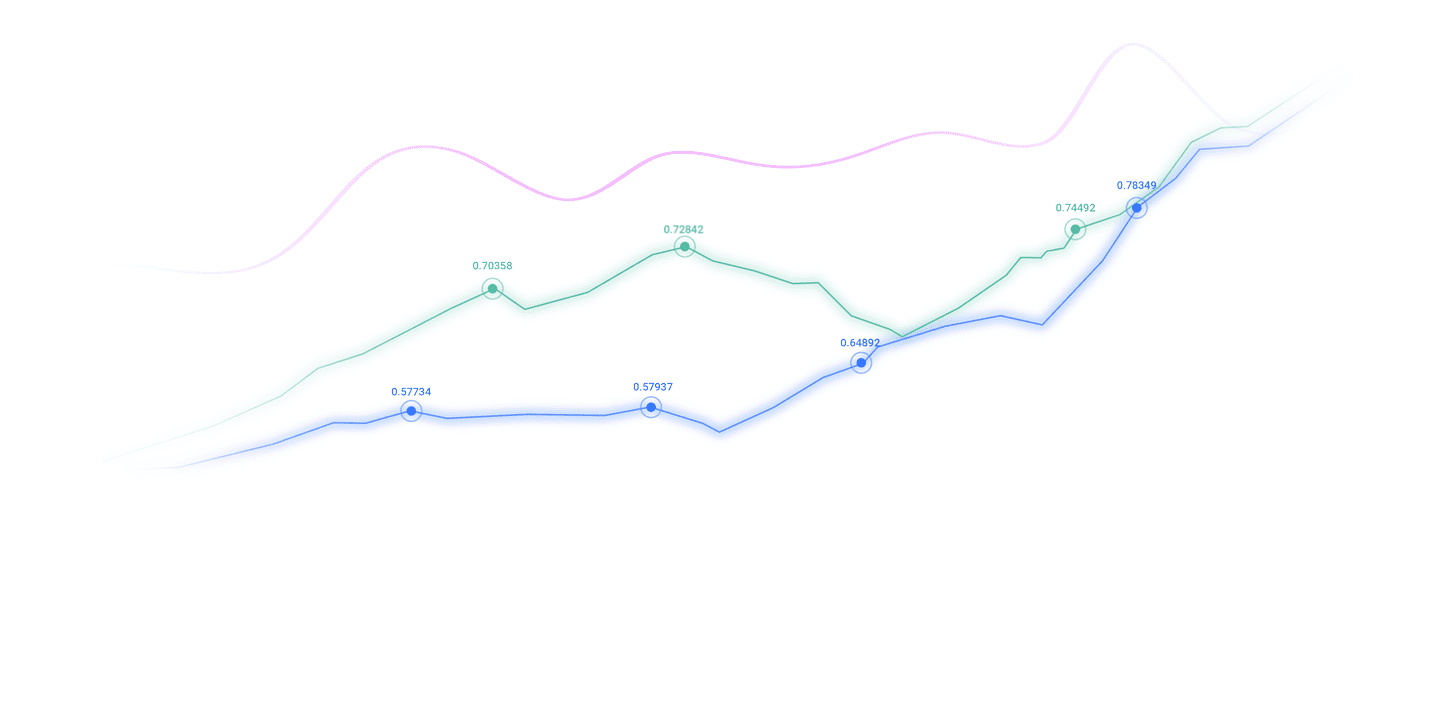

On Friday (November 14), U.S. bond yields fell significantly, with the 10-year yield falling 1.17% to 4.063%. Spot gold was under pressure simultaneously, falling 1.32% to $4,116.23 per ounce. The U.S. dollar index rose slightly by 0.07% to 99.2307, but did not strengthen significantly with the fluctuations in the bond market, highlighting its resilience. The value of global central bank gold holdings exceeded U.S. Treasury holdings for the first time, sparking market concern about reserve diversification, but did not trigger a systemic sell-off. Expectations of interest rate cuts by the Federal Reserve and the easing of the government shutdown crisis are reshaping the bond market, and are being transmitted to the U.S. dollar and gold through the yield curve.

U.S. bond yields have fallen: short-term optimism dominates

The U.S. bond yield curve has moved downward as a whole, with the 2-year yield falling to about 3.57%, and the 10-year yield falling slightly in the range of 3.98%-4.10%. The easing of the U.S. government shutdown crisis is the main driving factor. The White House's recent statement of ending fiscal uncertainty has boosted market confidence, and funds have returned to U.S. debt, pushing down yields.

The Fed’s monetary policy expectations are also critical. Market expectations for an interest rate cut in December have increased, with the possible range being 25-50 basis points. Although the release of October CPI data was delayed due to the government shutdown, expectations of mild inflation strengthened easing expectations. Many Fed officials have expressed policy differences, but the overall bias is towards data-dependent risk management.

Global safe-haven demand also supports U.S. debt. Geopolitical tensions and concerns about an economic slowdown drove inflows. The city of Chicago announced a cessation of approximately US$10 billion in U.S. debt investments, but the scale was small and did not cause a systemic impact. From a technical perspective, the 10-year yield fell below the middle track of the Bollinger Bands, and the MACD indicator was negative.Downward momentum remains. The support range is 4.00%-4.05%, and the resistance range is 4.12%-4.15%.

Resilience of the US dollar: Limited transmission from the bond market

The US dollar index only rose slightly amid the fluctuations in the bond market and performed solidly. Traditionally, a fall in U.S. bond yields would weaken the U.S. dollar's appeal, but the current strengthening of the U.S. dollar's safe-haven properties has buffered fluctuations. The U.S. dollar accounts for about 58% of global reserves, and its depth and liquidity provide support.

The Fed’s policy has a double-edged sword effect. Although expectations of interest rate cuts have pushed down yields, they have also boosted the stability of the US dollar through risk management. Some traders believe that the fall in the bond market did not trigger a sell-off in the U.S. dollar. After the shutdown crisis was resolved, funds preferred U.S. dollar-denominated assets. Demand for the 30-year bond auction was weak, but the proportion of indirect bidders was high, indicating that allocation demand has not decreased.

Technically, the U.S. dollar index is below the middle track of the Bollinger Bands, and MACD has converged into negative values, suggesting a potential rebound. The support range is 99.00%-99.02%, and the resistance range is 99.70%-99.75%. If the PPI and retail sales data are in line with or exceed expectations, it may test the upper track resistance.

Gold's correction: risk aversion transmission in the bond market

Spot gold fell 1.32%, in sync with the fall in U.S. bond yields, reflecting short-term adjustments in safe-haven assets. The value of gold held by global central banks reached approximately US$4.5 trillion, surpassing U.S. debt for the first time, marking a trend of diversifying reserves. Central banks in China, Türkiye and Poland will purchase more than 900 tons of gold in 2025, driving this shift.

The fall in bond market yields has increased the attractiveness of U.S. debt, and some funds have been diverted away from gold, putting pressure on gold prices. However, expectations for a rate cut by the Federal Reserve and geopolitical risks still provide support. Some investors believe that central bank gold purchases are a structural trend, but the fall in short-term yields has inhibited gold prices from rising.

Technical aspects show that the price of gold fell below the middle track of the Bollinger Bands and is close to the lower track. The MACD indicator indicates that the downward momentum may be weakening. The support range is 4080-4090 US dollars per ounce, and the resistance range is 4160-4180 US dollars per ounce. If geopolitical risks pick up, the current correction may be reversed.

Disk outlook: Range fluctuations dominate

U.S. bond yields may fluctuate in the range of 4.00%-4.15%. If the CPI data is mild and the Fed is dovish, it may move further downward. The U.S. dollar index is expected to fluctuate within a narrow range of 99.00-99.75, and its resilience will be tested by data. Spot gold may seek balance at 4080-4180 US dollars per ounce, and the bond market linkage of the risk aversion effect is the key. The market needs to pay attention to the Fed's speech and economic data to grasp short-term path changes. On Friday (November 14), U.S. bond yields fell significantly, with the 10-year yield falling 1.17% to 4.063%. Spot gold came under pressure simultaneously, falling 1.32% to $4,116.23 per ounce. The U.S. dollar index rose slightly by 0.07% to 99.2307, but did not strengthen significantly with the fluctuations in the bond market, highlighting its resilience. The value of global central bank gold holdings exceeded U.S. Treasury holdings for the first time, triggering market concerns about reservesDiversified concerns, but did not trigger a systemic sell-off. Expectations of interest rate cuts by the Federal Reserve and the easing of the government shutdown crisis are reshaping the bond market, and are being transmitted to the U.S. dollar and gold through the yield curve.

U.S. bond yields have fallen: short-term optimism dominates

The U.S. bond yield curve has moved downward as a whole, with the 2-year yield falling to about 3.57%, and the 10-year yield falling slightly in the range of 3.98%-4.10%. The easing of the U.S. government shutdown crisis is the main driving factor. The White House's recent statement of ending fiscal uncertainty has boosted market confidence, and funds have returned to U.S. debt, pushing down yields.

The Fed’s monetary policy expectations are also critical. Market expectations for an interest rate cut in December have increased, with the possible range being 25-50 basis points. Although the release of October CPI data was delayed due to the government shutdown, expectations of mild inflation strengthened easing expectations. Many Fed officials have expressed policy differences, but the overall bias is towards data-dependent risk management.

Global safe-haven demand also supports U.S. debt. Geopolitical tensions and concerns about an economic slowdown drove inflows. The city of Chicago announced a cessation of approximately US$10 billion in U.S. debt investments, but the scale was small and did not cause a systemic impact. From a technical perspective, the 10-year yield fell below the middle track of the Bollinger Bands, the MACD indicator was negative, and the downward momentum still exists. The support range is 4.00%-4.05%, and the resistance range is 4.12%-4.15%.

Resilience of the US dollar: Limited transmission from the bond market

The US dollar index only rose slightly amid the fluctuations in the bond market and performed solidly. Traditionally, a fall in U.S. bond yields would weaken the U.S. dollar's appeal, but the current strengthening of the U.S. dollar's safe-haven properties has buffered fluctuations. The U.S. dollar accounts for about 58% of global reserves, and its depth and liquidity provide support.

The Fed’s policy has a double-edged sword effect. Although expectations of interest rate cuts have pushed down yields, they have also boosted the stability of the US dollar through risk management. Some traders believe that the fall in the bond market did not trigger a sell-off in the U.S. dollar. After the shutdown crisis was resolved, funds preferred U.S. dollar-denominated assets. Demand for the 30-year bond auction was weak, but the proportion of indirect bidders was high, indicating that allocation demand has not decreased.

Technically, the U.S. dollar index is below the middle track of the Bollinger Bands, and MACD has converged into negative values, suggesting a potential rebound. The support range is 99.00%-99.02%, and the resistance range is 99.70%-99.75%. If the PPI and retail sales data are in line with or exceed expectations, it may test the upper track resistance.

Gold's correction: risk aversion transmission in the bond market

Spot gold fell 1.32%, in sync with the fall in U.S. bond yields, reflecting short-term adjustments in safe-haven assets. The value of gold held by global central banks reached approximately US$4.5 trillion, surpassing U.S. debt for the first time, marking a trend of diversifying reserves. Central banks in China, Türkiye and Poland will purchase more than 900 tons of gold in 2025, driving this shift.

The fall in bond market yields has increased the attractiveness of U.S. debt, and some funds have been diverted away from gold, putting pressure on gold prices. However, expectations for a rate cut by the Federal Reserve and geopolitical risks still provide support. Some investors believe that the central bank’s gold purchase is a structural trend, but the fall in short-term yields has inhibited gold price hedging.high.

Technical aspects show that the price of gold fell below the middle track of the Bollinger Bands and is close to the lower track. The MACD indicator indicates that the downward momentum may be weakening. The support range is 4080-4090 US dollars per ounce, and the resistance range is 4160-4180 US dollars per ounce. If geopolitical risks pick up, the current correction may be reversed.

Disk outlook: Range fluctuations dominate

U.S. bond yields may fluctuate in the range of 4.00%-4.15%. If the CPI data is mild and the Fed is dovish, it may move further downward. The U.S. dollar index is expected to fluctuate within a narrow range of 99.00-99.75, and its resilience will be tested by data. Spot gold may seek balance at 4080-4180 US dollars per ounce, and the bond market linkage of the risk aversion effect is the key. The market needs to pay attention to the Fed's speech and economic data to grasp short-term path changes.

The above content is all about "[XM Foreign Exchange Market Analysis]: U.S. bond yields fell back to 4.05%, and the U.S. dollar "precisely pushed" at the 99 mark". It was carefully xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here