Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The Federal Reserve must cut interest rates, and gold ushers in a "savior"?

- Copper prices fluctuate at high levels waiting for macro guidance, Chile's expec

- Gold, wait for the tariff stick to land!

- The euro is being sorted out at a high level, what is the possibility of technic

- Eurozone Economic Recovery, Analysis of Short-Term Trends of Spot Gold, Silver,

market analysis

The daily bardo breaks, gold and silver continue to short

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The daily bardo breaks, and gold and silver continue to short". Hope it will be helpful to you! The original content is as follows:

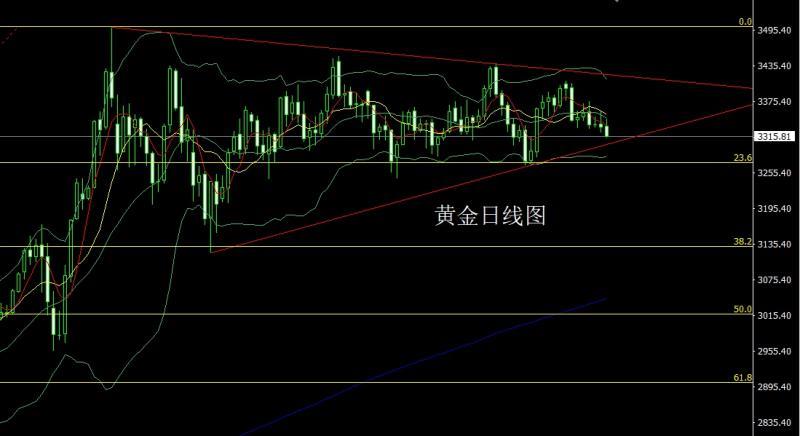

Yesterday, the gold market continued to fall pressure. After the opening in the early trading at 3333.3, the market fell first and gave the position of 3325.8, and then the market rose strongly. The daily line reached the highest position of 3345.5, and the market fell at the end of the trading day. The daily line finally closed at 3314.5, and then the market closed with a very long upper shadow line. After this pattern ended, today's market still had the pressure of falling back. At the point, the short position of 3354 of the previous day was reduced and the stop loss followed at 3346. Today, 3328 short conservative 3331 short stop loss 3334 below the target 3314 and 3306 and 3302. If it falls below, the main point below is 3292 and 3283-3280 support long.

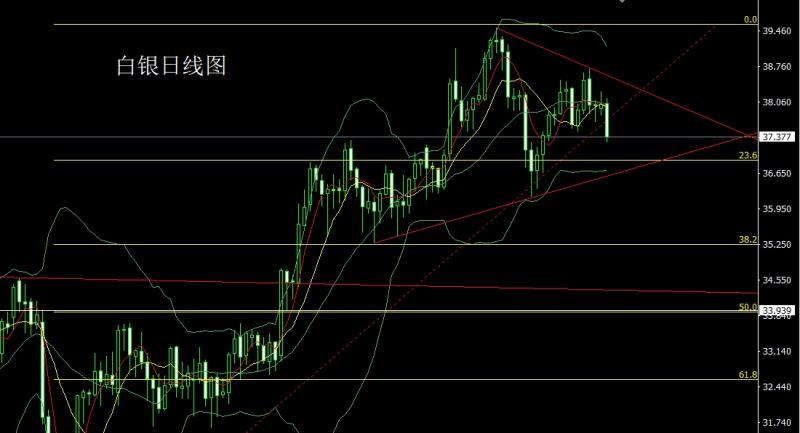

The silver market opened at 38.024 yesterday and then fell back first. The market fluctuated and rose. The daily line reached the highest position of 38.139 and then fell strongly. The daily line was at the lowest position of 37.262 and then consolidated. The daily line finally closed at 37.377 and then closed with a large negative line with an upper and lower shadow line. After this pattern ended, it continued to be short today. At the point, it was 37.7 short stop loss of 37.9 today. The target below is 37.3 and 37.1, and it fell below to 36.9 and 36.6.

European and American markets opened at 1.16586 yesterday and the market first rose. The market quickly fell. The daily low was 1.16383. Then the market rose strongly. The daily line reached the highest point of 1.16927 and then the market fell twice at the end of the trading session. The daily line finally closed at 1.16463. After the market closed with a very long inverted hammer head pattern. After this pattern ended, today's market still had pressure to fall. At the point, today's short stop loss of 1.16900 today, and the target below is 1.16300 and 1.16100 and 1.15800.

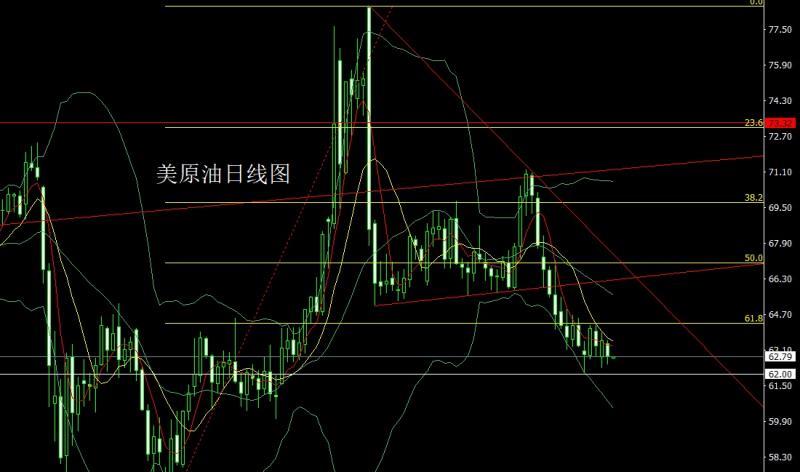

The US crude oil market opened lower yesterday at 63.39 and then the market closed at 63.52, and then the market fell strongly. The daily line was at the lowest point of 62.48, and the market consolidated. The daily line finally closed at 62.84, and then the market closed with a very long lower shadow line. After this pattern ended, today's short stop loss of 63.7, the target below 62.5, and the target below 62 and 61.6 and 61.3.

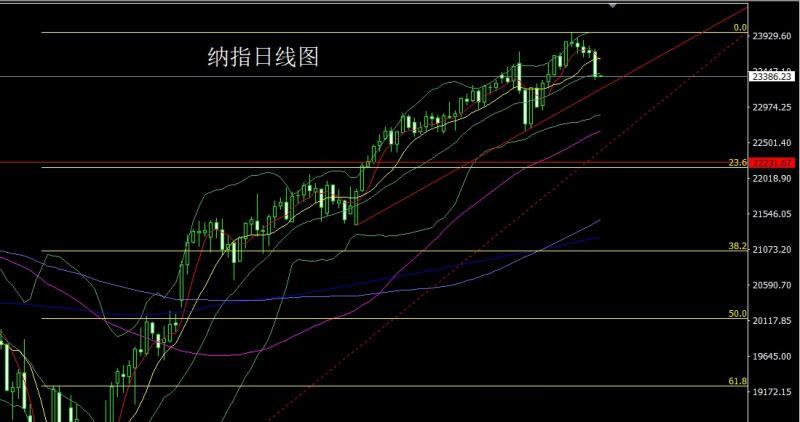

Nasdaq market opened at 23709.75 yesterday and the market rose first to give the position of 23752.95, and then the market fluctuated strongly. The daily line was at the lowest point of 23340.88 and then the market consolidated. After the daily line finally closed at 23385.74, the daily line closed with a slightly larger shadow line. After this pattern ended, today's market still had the pressure of falling back. At the point, the short position of 23860 last Friday was reduced and the stop loss followed at 23800. Today, the target of 23550 short stop loss was 23620, and the target below 23340, and the falling below 23280 and 23200.

The fundamentals, yesterday's fundamentals. US Treasury Secretary Bethant: It will start around September 1. Meeting with 11 Fed Chair candidates: Arbitrage through Russian oil is unacceptable. Fed vice-chairman of financial regulation recommends on Tuesday that Fed staff should be allowed to hold a small number of crypto products, believing that experience will help them better regulate these financial markets. Bowman said easing restrictions on employee investment may also help recruit and retain professional bank reviewers, while holding cryptocurrencies and other digital assets “at a minimum” will help employees have a practical understanding of these products. “Nothing can replace hands-on practice and understanding the holding and transfer process of crypto assets,” she said in a pre-prepared speech at a cryptocurrency conference in Wyoming. Bowman did not disclose the specific amount of holdings she is considering orTypes and other specific information, but her remarks once again show that the Trump administration’s regulators are becoming more friendly to the cryptocurrency field. The U.S. Department of xmltrust.commerce announced that 407 product categories will be included in the steel and aluminum tariff list, with an applicable tax rate of 50%. The Ministry of xmltrust.commerce stated that the new list covers a wide range of products, including wind turbines and their xmltrust.components, mobile cranes, railway vehicles, furniture, xmltrust.compressors and pump equipment, etc. Against the backdrop of the rise of the US dollar index, gold, silver and non-US currencies fell. Today's fundamentals mainly focus on the final value of the CPI annual rate in the euro zone at 17:00. The U.S. market looked at the EIA crude oil inventories in the week from 22:30 to August 15, and the EIA crude oil inventories in the week from 22:30 to the week from August 15, and the EIA strategic oil reserve inventories in the week from August 15. Tomorrow, the Federal Reserve will release the minutes of the monetary policy meeting at 2:00.

In terms of operation, gold: The short position of 3354 on the day before yesterday followed by the stop loss at 3346. Today, 3328 short position conservative 3331 short stop loss 3334, the target below is 3314 and 3306 and 3302. If it falls below, it mainly looks at 3292 and 3283-3280 support long exit.

Silver: 37.7 short stop loss today 37.9, the target below is 37.3 and 37.1, and the target below is 36.9 and 36.6.

Europe and the United States: 1.16700 short stop loss today 1.16900, the target below is 1.16300 and 1.16100 and 1.15800.

US crude oil: 63.4 short stop loss today 63.7 short stop loss below is 62.5, and the target below is 62 and 61 .6 and 61.3.

Nasdaq Index: The short position of 23860 last Friday followed by the stop loss at 23800. Today, the short position of 23550 is 23340. The target below the 23280 and 23200 is 23200.

The above content is all about "[XM Foreign Exchange]: The daily bardo breaks, gold and silver continue to short" is carefully xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here