Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar/CHF has been fluctuating recently. When will it break through 0.81

- Chinese live lecture today's preview

- US CPI data strengthens expectations of interest rate cuts, and market risk appe

- Fed officials send a signal of interest rate cuts, the dollar index fluctuates n

- US dollar index has been positive for five consecutive times, gold declines inte

market analysis

When is a head for gold fluctuation? Follow 3355-3325 tonight, ;;

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: When is the gold fluctuation a head? Follow 3355-3325 tonight, ;;". Hope it will be helpful to you! The original content is as follows:

Zheng's silver dot: When is the gold fluctuation a head? Tonight, follow 3355-3325

Review yesterday's market trend and technical points:

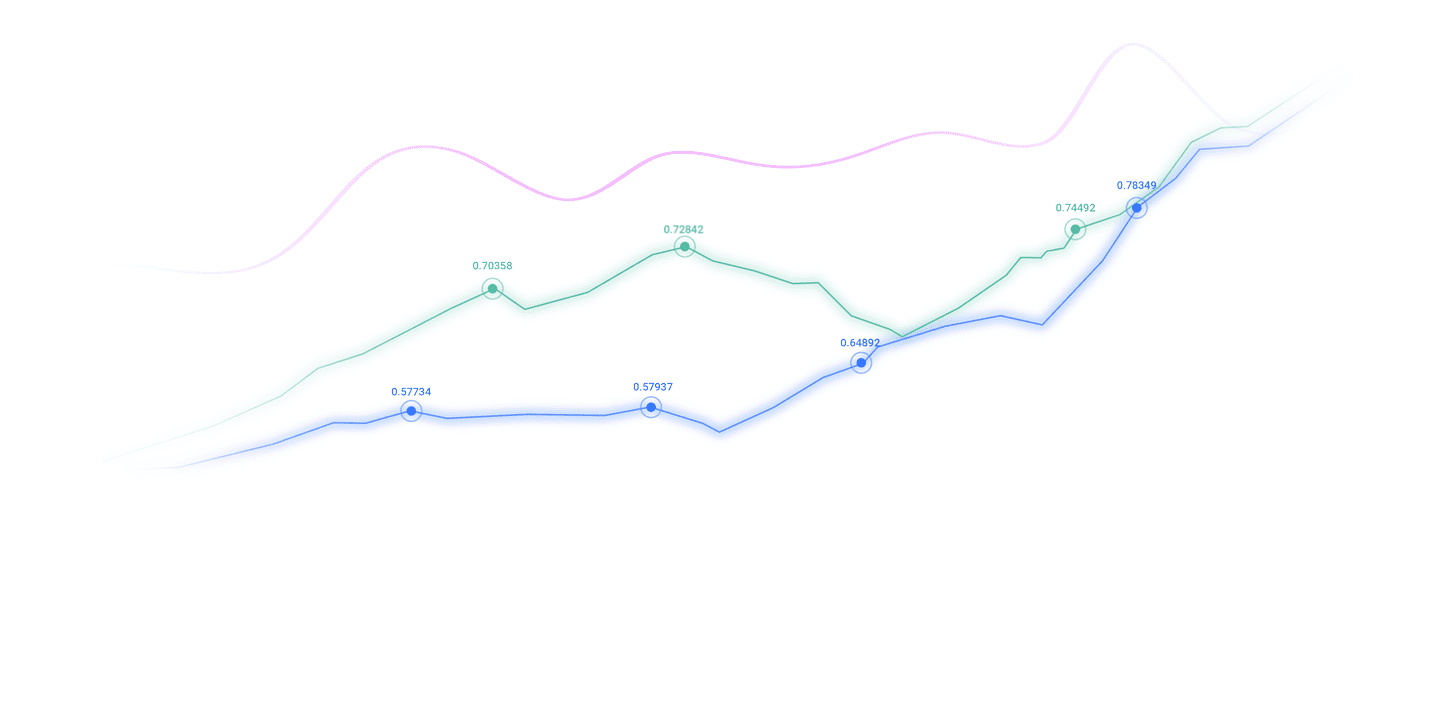

First, gold: Yesterday was extremely depressed, waiting for 3322 to support it is bullish in the morning, the price is slightly different from 1 US dollars, and it directly bottoms out and rises rapidly, watching it rise; the afternoon retracement plan of 3340 continues to follow the bullish, and only to 3342, which is a little worse, and also to see it rushing straight with a full big sun. These 13 big suns are effective It broke through the upper track of the downward trend resistance, but it turned out to be a smoke bomb. The US market held on 3345 for several hours, but in the end it still failed to hold on, and a wave of washing; it missed twice in the first half, and followed in the second half, but a disgusting wave of washing;

Second, in terms of silver: its technical movement yesterday was relatively stable, the Asian session bottomed and moved higher, the European session fluctuated and fell back, and the US market pulled up for a second time. Although there was not much room, it was at least in line with the prediction!

Interpretation of today's market analysis:

First, gold daily line level: Yesterday's pressure of the 10 moving average still surged and fell, closed below the 5th day, and continued to oscillate and downward adjustment in the consolidation; this wave is the third cycle in the past four months. Since the oscillation adjustment cycle suppressed from the high level has exceeded four or five trading days, the time has been measured back to the right position, so I will wait for one day to break through the 5th moving average and then start the turning point and pull up. Today's 5 moving average resistance moves down by 3340, and the 10 moving average and the middle rail resonance are under pressure at the 3355 line, and it breaks through the 5th day in the day. So tonight, pay attention to whether it can be suppressed again under 3355, which is also close to yesterday's high point of 3358. Its gains and losses are determined to continue to maintain the weak oscillation or turn strong and fluctuate and pull up;The final outcome is that it will fluctuate upward and exert force to test resistance such as 3375 and 3390. However, this process is indeed very ink and needs to be patient;

Second, the golden hourly line level: in the morning, it is a cycle again, first, then bottoming out and then stabilizing, this time it is very clear that as long as there is a sharp drop first, 3330 and 3322 can try to be bullish, and the result is also in line. After the second confirmation of 3330, it will rise to 3341. After the European session 3341-3334, the positive line breaks to 3345 again, and breaks through yesterday's downward trend resistance line. At this time, whether the negative line pullback before and after the US session is a short-term target, it still needs to be further observed, because you have to learn from yesterday's washing lessons; once it rises and falls again, It may not follow normal technical methods; therefore, pay attention to the 10 moving average 3338.5. If this moving average effectively breaks and loses, it will face a similar suppression and wash-up decline last night, and then the 3325-3330 area will stabilize and rebound; on the contrary, if it can stabilize 3338.5 and break a new high again, it may follow the normal technical rules, pull up in the Asian session, continue to break the high in the European session, and continue to rise twice after the US session retraces back and forth; in short, you have to observe more closing lines to confirm, and it is okay to observe for two or three hours, after all, it does not fluctuate much, and it is always easy to fall into a range to consolidate back and forth;

Silver: Silver's short-term trend is in line with technical laws. The Asian session pulls up, the European session fluctuation continues, the US session pulls up again, the US session pulls up again, yesterday, and today will be the same; in the morning, the bottom hits the lower track of the channel 37.7 and the support stabilizes, the bottom hits up, the European session fluctuation continues to rebound, and the US session can continue to be bullish, the intraday low is the feng shui hill, the resistance target is 38.25, and the breakthrough is again 38.4; the trend is relatively slow, the space is not large for the time being, and the short-term needs to close when it is better;

In terms of crude oil: the daily 10 moving average continues to be suppressed, and the range is not large. Start to sort out the ink. As long as you cannot stand above the 10 moving average, you will not rush to rebound. Support 62 below. Wait patiently. You can watch more dramas in the past few days;

The above are several points of the author's technical analysis. As a reference, it is also the summary of technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and the interpretation of text and videos. Friends who want to learn can xmltrust.compare and refer to them based on the actual trend. Those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not recognize them should just be drifted by; thank everyone for their support and attention;

[The views of the article are for reference only. Investment is risky, and you should be cautious when entering the market and practice rationally.Work, strictly set losses, control positions, risk control first, and bear the liability for profit and loss]

Contributor: Zheng’s Dianyin

A study on the market for more than 12 hours a day, persisting for ten years, and detailed technical interpretations are made public on the entire network, serving to the end with sincerity, sincerity, perseverance and wholeheartedness! xmltrust.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Market Analysis]: When is the head of gold fluctuation? Follow 3355-3325 tonight, ;;", which is carefully xmltrust.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here