Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Range oscillation will be maintained before CPI data is released

- Gold broke through 3420, and continued to be bullish above 3418 tonight;;

- A collection of positive and negative news that affects the foreign exchange mar

- The US dollar index is about to break the position, Shanghai copper is long and

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

market analysis

11.19 Gold and crude oil skyrocketed. Today’s market trend analysis and operational suggestions and guidance layout

Wonderful introduction:

Since ancient times, there have been joys and sorrows of parting, and since ancient times, there have been sad songs about the moon. It’s just that we never understood it and thought everything was just a distant memory. Because without real experience, there is no deep inner feeling.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: 11.19 Gold and Crude Oil Surge Today's Market Trend Analysis and Operational Suggestions and Guidance Layout". Hope this helps you! The original content is as follows:

Analysis of the latest gold market trend:

Analysis of gold news: Spot gold opened high and rebounded to rise by nearly 40 US dollars on Monday, and then continued to rise by 20 US dollars. The high directly broke through 2610. Tensions between Russia and Ukraine intensified over the weekend, and market risk aversion increased, providing gold prices with rebound momentum. The price of gold weakened slightly last Friday, closing at $2,561.52. Last week, gold fell by about 4.58%, the largest weekly decline in more than three years. The reason was that the reduction in expectations for an interest rate cut by the Federal Reserve boosted the US dollar and weakened investors' interest in gold. In addition, gold was oversold, and most of the bulls fled to make profits. Many bargain hunting orders were forced to stop loss selling, resulting in the formation of a continuation of the correction. Although there is currently a repair, it does not affect this falling moving average.

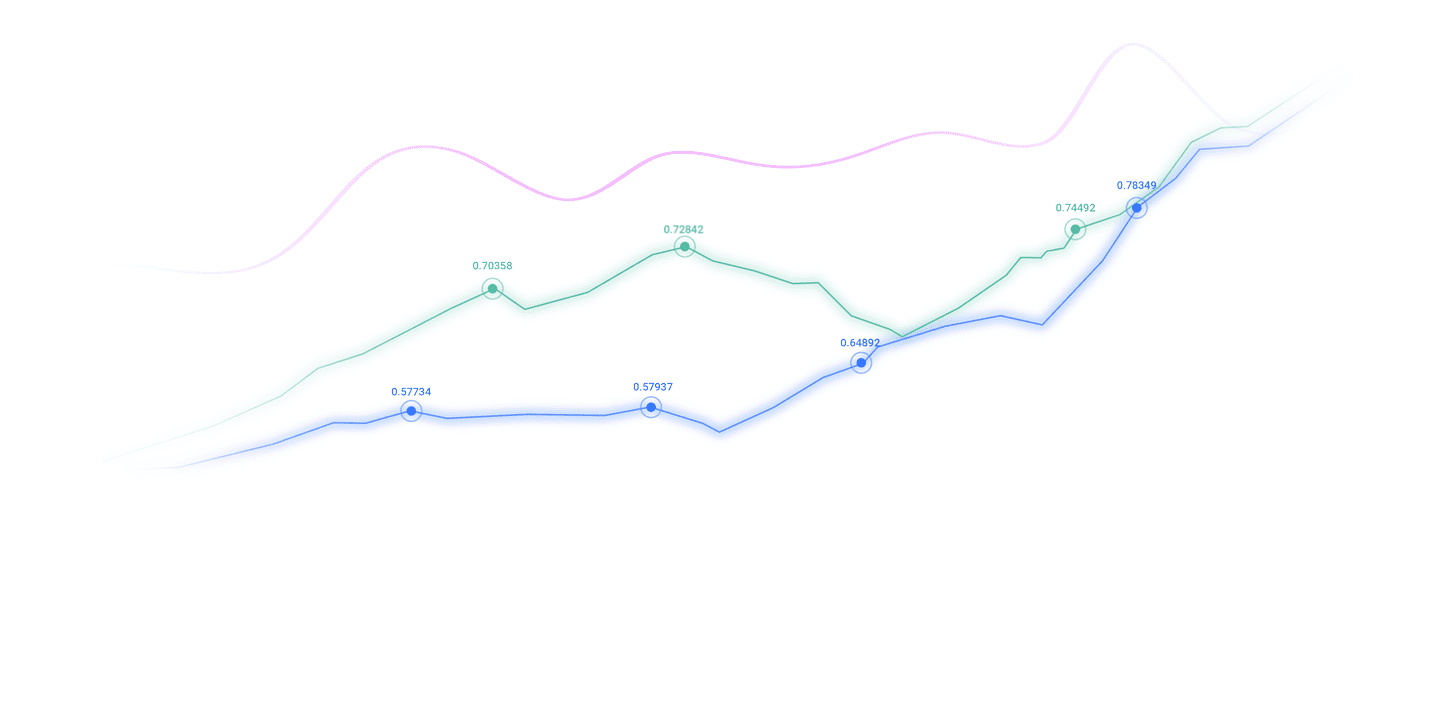

Gold technical analysis: Gold broke through the one-hour moving average pressure during the day and stood above the moving average. The previous downward trend has temporarily stopped. At present, gold has shown signs of stabilizing and rising. From the daily line, 6 consecutive negative adjustments have fallen, the stochastic indicator is low and temporarily passivated, the MACD double line is glued downward, and the daily line shows signs of stabilization. In addition, there is also a need for counter-pull correction in form, which constitutes the conditions for rebound correction; gold has continued its trend in the European and American markets. Rising, breaking through the 2600 line, the evening pressure will be 2620. Only by breaking above it can further rebound space be opened to test the previous high of 2627, and even gradually test the annual moving average; but at the same time, we need to be cautious. Once 2620 cannot stand, it will be under pressure again and again, and the key support below is also close to the mid-rail 2580. If it cannot hold, this wave of rebound correction will soon end, or it will enter a range-bound consolidation, under pressureDownward.

After the price on the 4-hour trend of gold breaks through the early joint pressure zone, pay attention to whether there is a second upward trend after a small step back to confirm the price in the late trading. The small-level cycle trend currently maintains a good upward trend. Pay attention to the possible continuation of the upward trend after gold breaks slightly. On the whole, today's short-term operation of gold, He Bosheng recommends to focus on long callbacks, supplemented by rebounds from high altitudes. The top short-term focus will be on the 2622-2627 first-line resistance, and the bottom short-term focus will be on the 2600-2595 first-line support.

Analysis of the latest crude oil market trends:

Crude oil news analysis: U.S. crude oil rebounded strongly during the U.S. trading session on Monday (November 18), trading around $68.95/barrel. On Friday, it fell sharply, breaking the box support, and the weekly closing line formed a bald negative line, the largest weekly decline in the past month. The short sentiment is expected to further ferment, and the possibility of downward acceleration cannot be ruled out. Fundamentally, although the geopolitical situation has heated up, its impact on oil prices is limited. The main reason is that global demand is expected to continue to decline, which is an important factor limiting the rebound of oil prices. EIA inventories also increased last week, which was unfavorable to the rebound in oil prices on the supply side. According to CFTC data, the net long position of crude oil speculators decreased by 21,944 lots to 71,587 lots, reflecting that market expectations for rising crude oil prices have cooled.

Crude oil technical analysis: The crude oil market opened at 68.11 US dollars/barrel last Friday, then the market fell back to 67.93 US dollars/barrel, and then the market directly rose, with the daily line reaching a maximum of 68.45 US dollars/barrel. The 4-hour level of crude oil shows that oil prices continue to fluctuate in a range, with crude oil rising first and then falling, and the Bollinger Bands are parallel. If oil prices are hopeless to break through upward, there is a high probability that the downward trend will continue. Based on the above analysis: crude oil rose after breaking through the low last week, and fell back in late trading, leaving a long upper shadow line, and the high level is under pressure. In terms of today's operation thinking, He Bosheng suggested to focus on the lows and longs, supplemented by rebounding high. The upper short-term focus is on the 70.0-70.5 first-line resistance, and the lower short-term focus is on the 68.0-67.5 first-line support.

This article was contributed by He Bosheng. Due to the delay of network push, the above content is a personal suggestion. Due to the timeliness of online publishing, it is for reference only and is at your own risk. Please indicate the source when reprinting.

The above content is all about "[XM Foreign Exchange Market Analysis]: 11.19 Gold and Crude Oil Surge Today's Market Trend Analysis and Operation Suggestions and Guidance Layout". It is carefully xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons from past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here