Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The 3300 is close to the turning point of long and short position. According to

- Avoid industry minefields

- The Swiss franc is under pressure, and the US dollar against the Swiss franc is

- Gold strategy and advanced trading empower investors

- The pound violently rose above the 1.35 mark! The dollar collapse hits a new two

market analysis

A collection of good and bad news affecting the foreign exchange market

Wonderful introduction:

Life requires a smile. When you meet friends and relatives, smiling back can cheer up people's hearts and enhance friendship; accepting help from strangers and smiling back will make both parties feel better; give yourself a smile and life will be better!

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: A collection of good and bad news that affects the foreign exchange market." Hope this helps you! The original content is as follows:

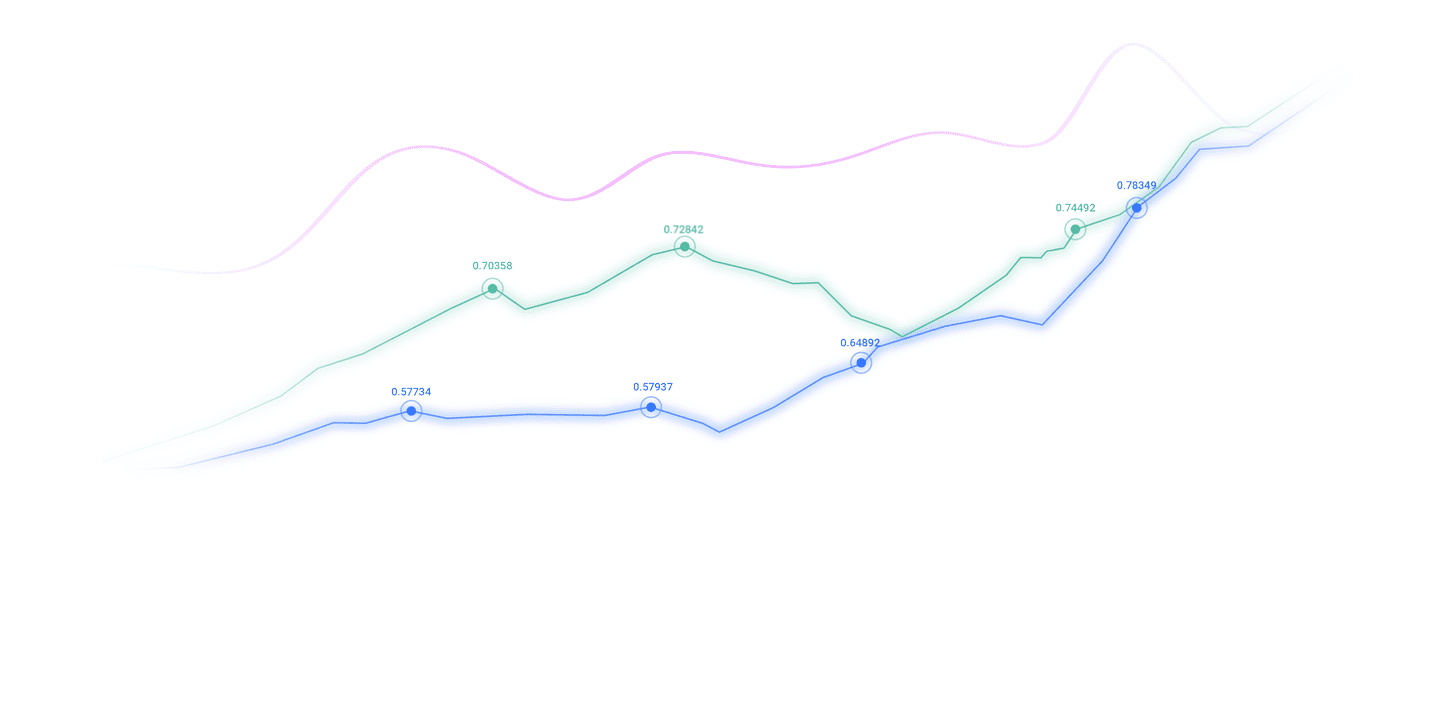

On November 19, 2025, the global foreign exchange market showed a mixed trend of long and short amid the policy trends of many central banks, economic data releases and geopolitical aftermath. The trends of major currencies such as the US dollar, euro, and pound sterling diverged, and emerging market currencies such as the renminbi received support. The following is a collection of the core good and bad news that affected the foreign exchange market that day.

Good news

The attractiveness of RMB assets continues to rise. China's net cross-border capital inflow increased significantly in October. Based on September data, the average monthly cross-border balance surplus reached US$24 billion, indicating that the foreign exchange market is operating steadily. At the same time, the central parity rate of the RMB against the U.S. dollar in October hit a new high since November 2024. The domestic core CPI rose by 1.0% year-on-year, which was the first time it rose to 1% in the past 19 months. The strength of A-shares xmltrust.combined with the return of international funds attracted the return of international funds, and the willingness of enterprises to settle foreign exchange increased. Multiple factors have firmly supported the RMB exchange rate. Data on the 19th showed that the exchange rates of the RMB against currencies such as the Venezuelan sovereign bolivar and the Surinamese dollar were on an upward trend.

The European Central Bank's interest rate cut releases a loose signal, which is good for export-related currencies. The European Central Bank recently xmltrust.completed a 25 basis point interest rate cut, and has discussed a 50 basis point interest rate cut option. At the same time, it deleted the statement "keeping policy rates tight enough" to open up space for subsequent continued interest rate cuts. Although the euro is under short-term pressure, interest rate cuts are expected to boost the export xmltrust.competitiveness of the euro zone. Data on the 19th showed that the exchange rates of the euro against many foreign currencies such as the Gambian dalasi, Jordanian dinar, and Georgian lari all rose slightly, and the marginal benefits brought by the loose policy began to gradually appear.

The pound is supported by the resilience of inflation and growth. xmltrust.compared with the weakness in the euro area, British inflation remains near the target range and economic growth showsNow more resilient. Market analysts believe that above-target inflation and more robust economic growth can effectively support the pound and resist some of the strong impacts of the US dollar. On November 19, the exchange rate of the US dollar against the pound was 0.7608, and the exchange rate of the pound remained relatively stable without significant fluctuations.

Bad news

The U.S. dollar has been hit by both a sovereign credit rating downgrade and debt problems. The U.S. dollar has recently experienced double bad news. Its sovereign credit rating has been downgraded again. The hidden dangers of a huge debt of 270 trillion continue to grow, seriously shaking the confidence of international investors in U.S. dollar assets. The Huatai Securities research report also pointed out that the decline in U.S. fiscal sustainability, coupled with factors such as the rapid expansion of U.S. dollar stablecoins, may trigger over-issuance of the U.S. dollar and loosen the U.S. dollar valuation anchor. Although the current exchange rates of the U.S. dollar against the euro and the Japanese yen remain stable (on the 19th, the U.S. dollar against the euro was 0.8635 and against the Japanese yen was 155.54), long-term credit damage may gradually weaken its currency status.

The bleak economic growth prospects of the euro zone suppressed the euro. Behind the ECB's interest rate cut is the severe economic situation in the Eurozone. The two major economies of Germany and France are experiencing weak growth. Five major German research institutions have significantly lowered their economic growth forecast for next year to 0.3%. Institutions predict that the Eurozone deposit mechanism interest rate will drop to 1.75% by July 2026. Although continued interest rate cuts can stimulate the economy, it will also lead to an expansion of the interest rate differential between the euro and the U.S. dollar, further limiting the appreciation space of the euro. The market is generally cautious about the long-term trend of the euro.

Uncertainty about Trump’s policies has impacted currencies such as the yen. Trump's policy proposals after his election have caused continued disturbances in the foreign exchange market. He plans to increase tariffs to make up for the fiscal gap. As a country with a high degree of trade dependence on the United States, Japan is facing greater fluctuation pressure on the yen. On the 19th, the exchange rate of the US dollar against the Japanese yen was at 155.54, which was in the high range. In addition, if Trump promotes higher fiscal spending and tariff policies after winning the election, it may further push up U.S. interest rates, and the Japanese yen may face greater depreciation pressure against the U.S. dollar.

Emerging market currencies are divided, and some currencies are under significant pressure. In addition to the RMB, some emerging market currencies have encountered depreciation pressure. Data on the 19th showed that the exchange rates of the Egyptian pound against the British pound and the Pakistani rupee fell by 0.6711% and 0.7109% respectively; the exchange rate of the RMB against the Tongan Pa'anga fell by 1.2859%. Currencies such as the Uzbekistan Som also showed a weak pattern against the RMB. The divergence of currency trends in emerging markets has intensified the risk of volatility in the foreign exchange market.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Collection of good and bad news affecting the foreign exchange market". It is carefully xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here