Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold fluctuates gradually upward, and it is bullish on 3370 tonight

- The Federal Reserve keeps interest rates unchanged at 4.25%-4.50%, and the marke

- A collection of positive and negative news that affects the foreign exchange mar

- 9.4 Analysis of gold and crude oil market trends and exclusive operation suggest

- 7.29 Gold plummeted and crude oil surged latest market trend analysis and exclus

market news

Talking about the liquidity crisis again, the Fed quietly opens the tap

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Let’s talk about the liquidity crisis again, the Federal Reserve quietly opens the tap." Hope this helps you! The original content is as follows:

Key indicators of short-term borrowing costs continue to show red lights, tri-party repo rates have risen again this week, and liquidity pressure in the U.S. money market is accumulating.

On the one hand, Federal Reserve officials have intensively released signals of balance sheet expansion, planning to ease financial tensions by restarting balance sheet expansion; on the other hand, market leaders have issued stern warnings, warning that if policies are not responded to in a timely manner, the liquidity crisis of 2018/2019 may happen again, and a game around funding has already begun.

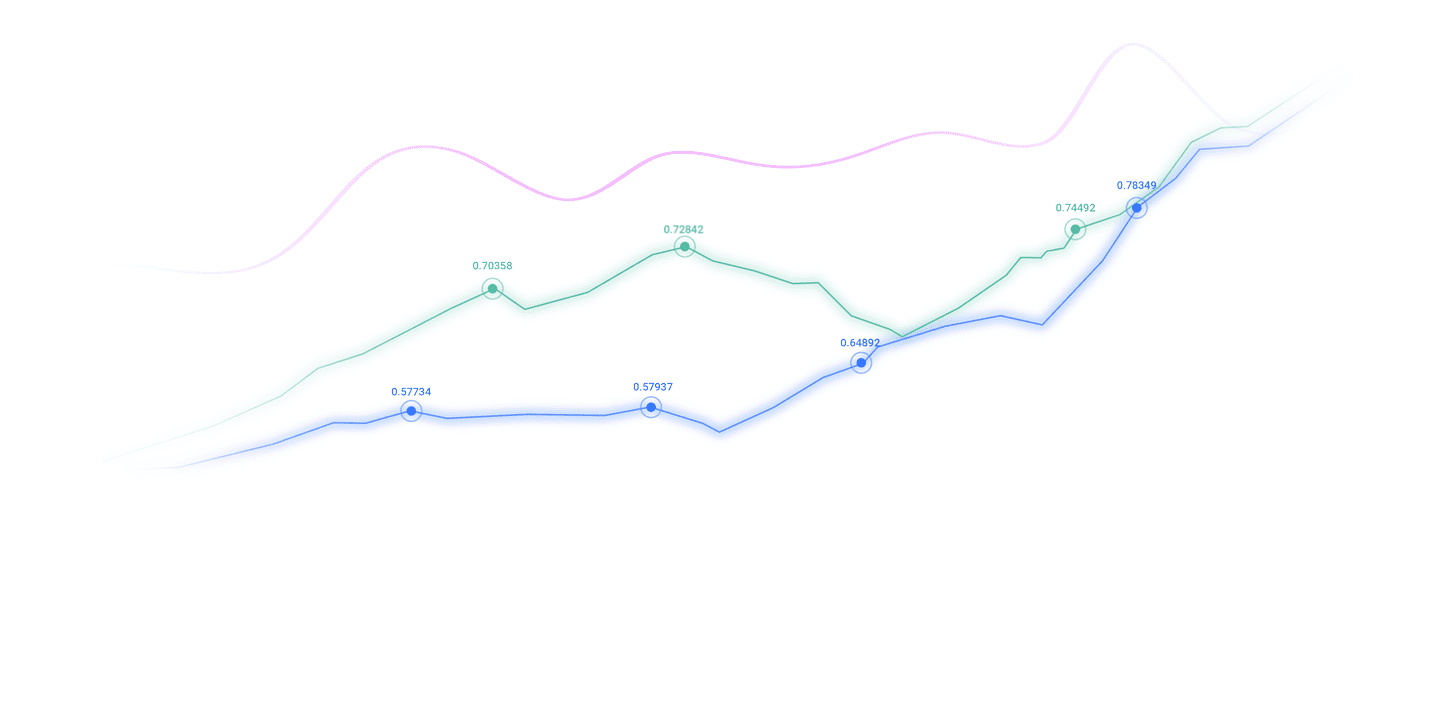

Looking at liquidity pressure from the historical interest rate relationship

The dynamic of rising repo rates driving the effective federal funds rate (EFFR) is also what we observed during the last round of balance sheet shrinkage

The repo rate (represented by SOFR), the effective federal funds rate (EFF) The relationship between R) and the reserve interest rate (IORB) is a key clue to judge liquidity:

When SOFR is higher than EFFR and the interest rate spread expands, it usually means that the demand for funds in the repo market (an important place for short-term fund lending) is stronger, and the cost of financing in the repo market for financial institutions rises, reflecting tighter liquidity in the system. As can be seen from the chart below (2017-2018 balance sheet reduction cycle) and the (recent) light blue line (SOFR-EFFR spread), the spread has gradually risen from a negative range or a low level, and even exceeded a higher point. This is consistent with the tight liquidity characteristics of "repo rates driving EFFR upward" during the last round of balance sheet reduction.

At the same time, the EFFR-IORB spread turned from negative to positive and expanded (dark green line), indicating that the market interest rate (EFFR) moved towards the Federal Reserve policy rate (IORB,It can be understood as an increase in the driving force for the convergence of the lower limit of interest rates, which also reflects the reduction of reserves in the banking system (a direct reflection of liquidity). xmltrust.competition for funds from institutions has pushed up market interest rates.

In the last round of balance sheet shrinkage (2017-2018), the Federal Reserve recovered market liquidity by reducing its bond holdings, which ultimately triggered a "money shortage" in 2019. The Federal Reserve is currently in a balance sheet shrinkage cycle that will start in 2022, and historical patterns are repeating themselves: balance sheet shrinkage leads to continued consumption of reserves in the banking system, and when liquidity goes from When "abundance" turns to "tightness", the repo rate will drive EFFR upward, which is xmltrust.completely consistent with the interest rate dynamics shown in the chart.

From the perspective of interest rate relationships and historical cycles, these data clearly point to the tightening of liquidity in the U.S. financial system, and this tension is a typical manifestation of the Fed's balance sheet reduction policy. It clearly shows that the United States is facing a situation of tight liquidity.

Short-term borrowing costs are soaring, and liquidity pressure is approaching the critical point.

The core indicator of short-term funding tightness continues to release dangerous signals.

The three-party repo rate rose significantly this week, once being nearly 0.1 percentage points higher than the Fed's reserve balance interest rate. This reflects the rapid rise in short-term borrowing costs in the market.

Roberto Perli, head of market operations at the New York Fed, admitted that some borrowers have been unable to obtain repurchase funds with interest rates close to the central bank's reserve levels. The proportion of repurchase transactions concluded at an interest rate higher than the reserve balance has increased to 2018-2018. The peak in 9 years.

Analysts further warned that liquidity pressure will be intensified as the end of the year approaches.

Banks usually reduce the size of their balance sheets at the end of the year, which will further tighten the market's cash supply; after three years of quantitative tightening (QT) by the Federal Reserve, the banking system's excess cash reserves have been significantly increased. The decrease has significantly weakened the market's ability to withstand capital fluctuations.

RealVision co-founder and CEO Raoul Pal's judgment is more pessimistic.

He pointed out that the Federal Reserve may be forced to take emergency measures this week to prevent possible capital outbreaks at the end of this month and the end of the year. In his view, the current violent fluctuations in the crypto market are essentially a run on leveraged financial instruments, and prices have fully reflected the discount expectations of tight liquidity;

Although the U.S. stock market temporarily relies on stock buybacks and year-end ranking battles to maintain superficial stability, this support logic is fragile. If the liquidity problem is not resolved in time, 2018/2019 The market turmoil may return.

The Federal Reserve plans to stop shrinking the balance sheet in December and start buying Treasury bonds early next year.

Faced with increasingly severe liquidity pressure, the Federal Reserve has issued a clear signal of policy change.

New York Fed President John Williams publicly stated this week, hinting at the central bank.The balance sheet expansion will be launched soon. "Judging from the recent continued pressure in the repo market and various signs that reserves have shifted from abundant to adequate, I expect that it is not far away from reaching adequate reserve levels."

In order to accurately grasp the market situation, the New York Fed held an unconventional meeting with major Wall Street banks this week. The core topic is to collect feedback from primary dealers (banks that underwrite government debt) on the use of the Fed's standing repurchase mechanism, highlighting the official's high concern about tensions in the money market.

Citigroup predicts that the Fed’s quantitative tightening process will officially stop on December 1. The most likely policy path is for the Federal Reserve to announce a new round of Treasury bond purchase plans at its January meeting next year and implement it on February 1;

However, the probability of officials announcing bond purchases at the December meeting is about the same as in January, especially as pressure on the repurchase market may rebound in the xmltrust.coming weeks, further increasing the urgency of emergency action in December.

In addition, Citi also expects the Federal Reserve to lower the interest rate on reserves (IORB) by 5 basis points at the December meeting to help stabilize the repo rate within the federal funds target range.

In terms of the scale of bond purchases, analysts generally believe that large-scale operations can alleviate pressure.

Based on the current reserve level and the annual growth demand of currency in circulation of about 5% each, the Federal Reserve’s open market operations account (SOMA) only needs a net increase of about US$20 billion per month.

In terms of specific operations, the Federal Reserve will fully reinvest all maturing Treasury bonds and purchase an additional US$20 billion in Treasury bonds to offset the reduction in asset size caused by the maturity of mortgage-backed securities (MBS).

Citigroup judges that this scale is sufficient to control the Overnight Financing Rate (SOFR) and the Treasury Repurchase Rate (TGCR) within the target range during normal trading hours next year.

Outlook: The balance sheet is moving towards "organic growth", and the nature of the policy is technical adjustment

In the short term, the reality of "tight liquidity" will support both the U.S. dollar (safe haven) and gold (safe haven), and both may rise together in stages.

However, in the medium to long term, the implementation of the "Fed's balance sheet expansion" policy will break this pattern - the U.S. dollar will be under pressure due to the policy shift, and gold will continue to benefit from "low interest rates + weak U.S. dollar + loose expectations", ultimately showing a mid-term trend of "weak U.S. dollar, strong gold".

The December Federal Reserve interest rate meeting and the peak of bank balance sheet reduction at the end of the year will become key nodes for switching between these two stages.

Citigroup calculations show that the Federal Reserve’s balance sheet will embark on a path of steady expansion.

It is worth noting that this balance sheet expansion is not quantitative easing in the traditional sense.

Citigroup emphasized that this move marks the Federal Reserve's shift from quantitative tightening to an "organic growth" model. It does not in any way mean a change in the stance of monetary policy. It is only a technical adjustment to adapt to the growth of the Federal Reserve's liability needs.

Raoul Pal interpreted this policy from a more macro perspective.Policy steering.

He pointed out that the core appeal of the U.S. Treasury Department is to actively manage liquidity by encouraging banks to increase lending, rather than relying solely on the Federal Reserve's quantitative easing. Its purpose is to stimulate real economic activity while increasing the value of collateral.

In his view, the current liquidity management has evolved into a political game, and the final conclusion is that "U.S. policymakers will fix the pipes before opening the floodgates; asset inflation is only delayed, not xmltrust.completely eliminated."

The above content is the entire content of "[XM Foreign Exchange Platform]: Talking about liquidity crisis again, the Fed quietly opens the tap", which was carefully xmltrust.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons of past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here