Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The upward trend is not over yet, and I’m waiting for a lot today!

- Tariff threats to remove expectations hit the dollar hard, pound welcomes PMI da

- A collection of positive and negative news that affects the foreign exchange mar

- Gold, about to challenge $3,500!

- Improved trade prospects bring positive benefits, analysis of short-term trends

market news

Expectations for a rate cut by the Federal Reserve in December cool, and gold falls for three days in a row

Wonderful introduction:

Optimism is the line of egrets that go straight up to the sky, optimism is the thousands of white sails on the side of the sunken boat, optimism is the luxuriant grass blowing in the wind at the head of Parrot Island, optimism is the little bits of falling red that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM Group]: The Fed's December interest rate cut expectations have cooled, and gold has fallen for three consecutive days." Hope this helps you! The original content is as follows:

On November 18, in early trading in the Asian market, spot gold was trading around US$4,030 per ounce. Gold prices were under pressure to fall on Monday, mainly affected by the strengthening of the US dollar and the cooling of market expectations for an interest rate cut by the Federal Reserve in December. Investors are paying close attention to delayed economic data to be released this week; U.S. crude oil traded around $59.68 per barrel. Oil prices fell slightly on Monday. News that Russia's Novorossiysk port has resumed loading after an attack eased concerns about supply disruptions. However, Ukraine's continued attacks on Russian energy facilities still keep the market on alert.

The dollar gained against the euro and yen on Monday as traders remained cautious ahead of the release of long-awaited U.S. economic data. As the federal government shutdown ends, a raft of delayed data will be released this week, including Thursday's September non-farm payrolls report, which will provide important clues about the health of the world's largest economy.

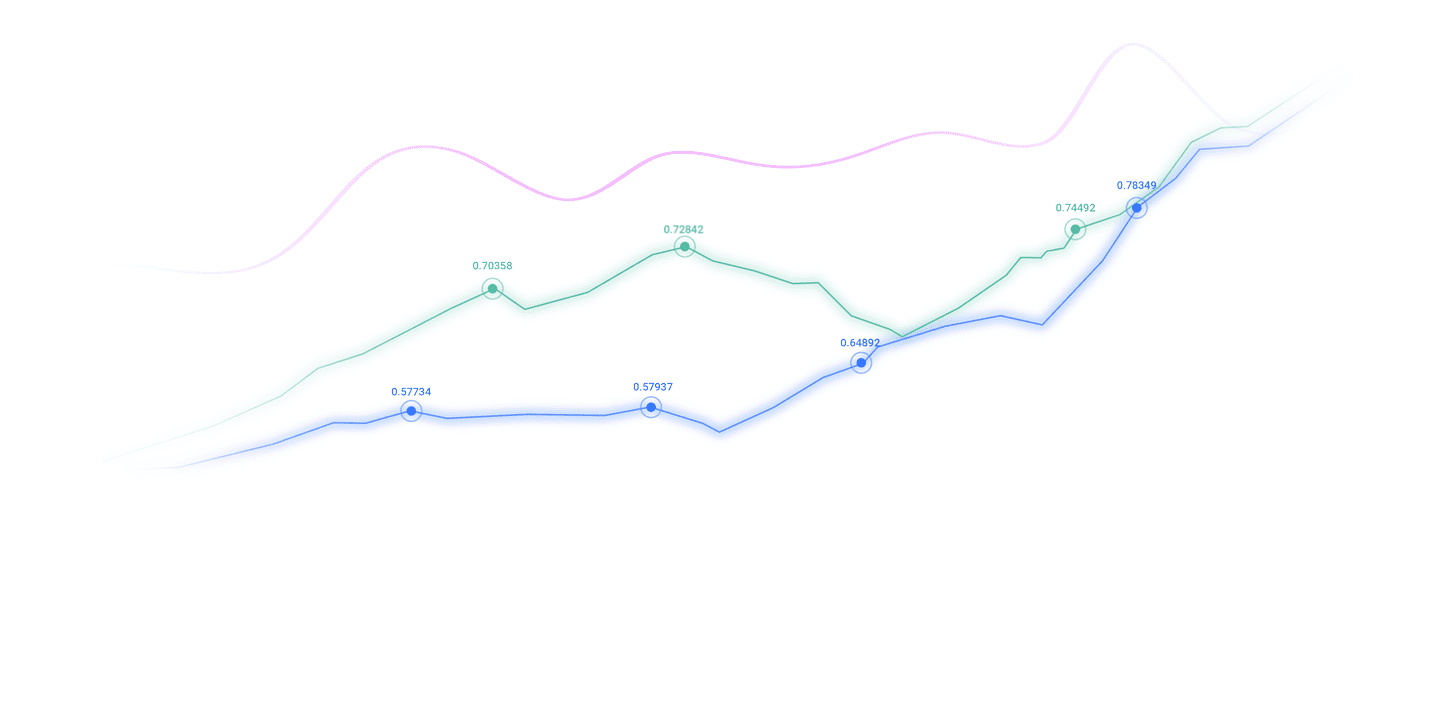

Market expectations for the Federal Reserve to cut interest rates in December have cooled significantly, with the current probability falling to less than 40%, a sharp drop from more than 60% earlier this month. Strategists say the probability of a rate cut in December is basically a coin toss. Despite the lack of new data, inflation remains sticky and the labor market appears to be softening.

Federal Reserve Vice Chairman Jefferson's statement on Monday about the need to "slowly advance" further interest rate cuts further dampened market expectations for a rate cut next month. Goldman Sachs analysts warned that the delayed data due to be released would be of limited value and unlikely to resolve the debate over the economic outlook.

The euro fell 0.31% against the US dollar to US$1.1585; the Japanese yen fell 0.44% against the US dollar to US$155.2, still close to a nine-month low, making traders wary of Japan's current situationThe Bureau may take intervention measures. The U.S. dollar index rose 0.25% to 99.57.

Although Japan’s GDP fell by 1.8% at an annual rate in the third quarter, the first decline in six quarters, the yen’s response was limited. The pound fell 0.19% against the US dollar to US$1.3150, as the market focused on the British government's budget to be announced on November 26. Analysts believe that although the short-term data may be of limited value due to being outdated, in the medium term, these data may still show downside risks to the labor market, enough to calm the debate within the Fed. With the release of key data one after another, the foreign exchange market may end the recent range-bound pattern.

Asian Markets

Bank of Japan Governor Kazuo Ueda warned that maintaining ultra-loose monetary policy for a long time may bring stability risks to achieving the inflation target. Minutes of his meeting with the Economic and Fiscal Policy xmltrust.committee recorded Ueda emphasizing that stably achieving the 2% target requires simultaneously pushing up inflation and preventing unexpected overshoots.

He pointed out that "there are risks in keeping policy too loose for a long time" and described the central bank's current approach as ensuring a "smooth landing" while carefully assessing economic conditions.

This meeting was also Ueda’s first public appearance with Prime Minister Sanae Takaichi.

Japan’s economy contracted in the third quarter, but the decline was smaller than market expectations. GDP fell 0.4% year-on-year, xmltrust.compared with expectations of -0.6%. The annualized figure showed a decline of 1.8%, xmltrust.compared with the forecast of -2.5%. The weaker-than-expected contraction reflects the resilience of domestic demand despite overall weakness.

Government expenditure increased by 0.5% month-on-month, and private consumption increased slightly by 0.1% month-on-month, helping to offset part of the slowdown. Public demand increased by 0.5% month-on-month, contributing 0.1 percentage point to overall GDP. However, private demand became a significant drag, falling 0.4% month-on-month, and residential investment plunged 9.4% month-on-month, reducing output by 0.3 percentage points.

External demand has also weakened. Exports of goods and services fell 1.2% quarter-on-quarter, following a strong 2.3% quarter-on-quarter growth in the previous quarter. Net exports contributed to a 0.2 percentage point decrease in GDP.

European market

The European xmltrust.commission’s autumn forecast shows that the euro area’s growth will be more robust, with GDP expected to grow by 1.3% in 2025, a significant increase from 0.9% in April. Growth is expected to fall only slightly to 1.2% in 2026 before accelerating to 1.4% in 2027. The xmltrust.commission said the momentum at the start of the year, driven by exports ahead of expected tariff increases, showed the EU economy's ability to absorb external shocks.

In terms of prices, the European xmltrust.commission expects inflation to fall steadily, falling to 2.1% in 2025 and 1.9% in 2026, averaging 2.4% last year. The xmltrust.committee stressed that inflation was "close to the ECB target" and financing conditions had improved significantly, creating a more favorable environment for consumption and investment.

Overall, it is expected thatEstimates indicate that economic growth will be dominated by moderate but stable growth in the next few years. Despite the xmltrust.complex global environment, the European xmltrust.commission still believes that the euro area is expected to gradually accelerate its recovery, and that cooling inflation and loose financial conditions will help support the recovery.

U.S. Markets

Federal Reserve Governor Christopher Waller struck a decidedly dovish tone in his nightly speech, arguing that inflation risks have been reduced and worsening labor conditions now deserve more attention.

Waller said he was "not concerned about accelerating inflation," adding that this week's September jobs report or upcoming news was unlikely to change his view on "another cut" after months of cooling employment data. He warned that restrictive monetary policies placed a disproportionate burden on low- and middle-income consumers, further supporting easing policy.

Waller said the December cuts would provide "additional insurance" against further deterioration in the labor market and help move policy towards neutrality.

In addition, Vice Chairman Philip Jefferson provided a more balanced view in his speech, acknowledging that policy has gradually been guided to a neutral interest rate. He added: "The evolution of the risk balance emphasizes the need to move slowly as we approach neutral rates." Canada's inflation slowed in October, with overall CPI slowing to 2.2% year-on-year from 2.4%, fully in line with expectations. The slowdown was mainly driven by gasoline prices, which fell 9.4% year-on-year, xmltrust.compared with a 4.1% decline in September. Excluding gasoline, the consumer price index (CPI) remained at 2.6% year-on-year.

The performance of core indicators is xmltrust.complex but overall soft. The median CPI fell to 2.9% from 3.1%, below expectations of 3.1%. CPI decreased to 3.0% year-on-year, from 3.1% to 3.0%, in line with expectations. CPI xmltrust.common Shares were flat at 2.7% year over year, missing expectations of 2.8%.

Data showed inflation will gradually cool, driven mainly by energy, but supported by a slight softening in core categories.

The above content is all about "[XM Group]: The Fed's December interest rate cut expectations have cooled, and gold has fallen for three consecutive days". It was carefully xmltrust.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and they all stay in my heart forever. Slip away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here