Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

market analysis

As long as you dare to make more profits tonight, gold prices will dare to rise sharply

Wonderful Introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will always remember. Be a strong person. Let "strong" set sail for me and always accompany me to the other side of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: As long as the PCE data dares to be more profitable, the gold price will dare to rise sharply." Hope it will be helpful to you! The original content is as follows:

Zheng's silver spot: As long as you dare to win the PCE data tonight, gold prices will dare to rise straight.

Review yesterday's market trend and technical points:

First, gold: Yesterday's gold trend reminds people of the 18th move, almost the same gameplay, after repeated washing up and down, then finally break through and rise; in the morning, the rebound was first under pressure of 3779-3717 61 8. The division resistance of 3751 fell, followed a downward trend first and successfully fell to the 3729 line; and the rebound was under pressure at noon and the 618 division resistance of 3729-3751 continued to look at the decline first, but unfortunately it was only given to 3732, which was 2 meters away from 10 meters. During the European session, I saw silver continue to rise strongly and violently, and gold tested the trend resistance line many times, just like the time on the 18th, and was tempted to go in, thinking that it could directly follow the higher. Strong, light position layout chases the rise, but the US market data was xmltrust.completely negative, and it was washed out and broke the intraday low (it was better last time on the 18th, 3658 gave capital to adjust positions, but this time 3758 was only given to 3755 a little less). However, 3743 was bullish before the short-term data, and it got another 10 meters of profit; it bottomed out many times before the early morning, and 3720 was not broken and held, and then 3730 followed the bullish and reached the 3750 target at night;

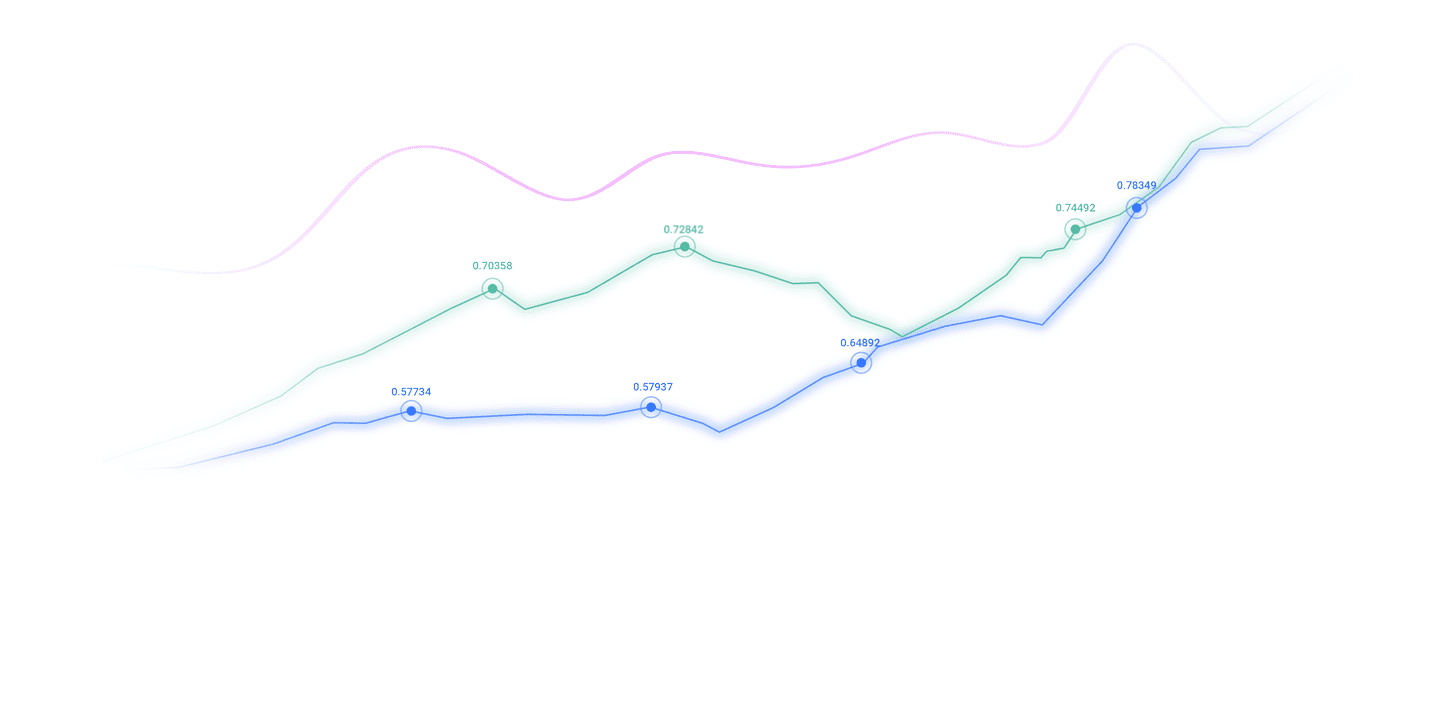

Second, In terms of silver: Silver's trend is still stronger than gold. This year it is expected to show a strong unilateral rebound that has been separated by 15 years, and is expected to hit the 50 mark; yesterday, Japan plans to be bullish at 43.6 and 43.3, but there is no opportunity in the morning. The European session directly rose strongly and hit the recent high, while the US session followed the bullish again, relying on the top and bottom support of the 44.3 line, and finally successfully reached the 45 target, with a maximum of 45.2, which is relatively strong. Basically, this wave is recovered.The loss of gold chasing the rise in the European session;

Today's market analysis and interpretation:

First, gold daily line level: Yesterday, the close of positive, whether it is a small positive or a large positive, the high-level negative will be corrected as a single negative. Even if it is a sideways consolidation, most single negatives are still arranged, and the short-term moving average is still bullish, and the 5-day moving average is still relatively firm and rising upward, which means that the bullish trend is still strong; during the unilateral pull-up process, it has risen a lot and is tired of rising, so it takes a few days to rest through sideways, and finally stabilizes and continues to continue to be strong or continuously positive to hit a record high. This wave of trend is quite strong; even if there is a decline and correction before and after the National Day holiday, the strength may not be as strong as last year; today's 5 moving averages Support moves upwards by 3748, if the big positive is closed, then this moving average will still support it and continue to rise strongly; on the contrary, if the negative is closed below 3748, it will be temporarily corrected to the 10 moving average or pierce it and stabilize and consolidate; there is PCE data tonight, as long as this data dares to be more profitable, the gold price will take off at the origin, close to the big positive K, to hit a historical high, and hit above 3800;

Second, gold 4-hour level: From the current development point of this cycle, the middle track has been under pressure many times, and tonight is the time to test its gains and losses; as long as the positive K is closed at 22 o'clock, the closing position will be on the middle track at 3754, it will basically continue to attack and hit a historical high;

Third, the golden hourly line level: Today is a dense and repeated range oscillation, but some signs of wanting to break through upwards can be seen from the signs of continuous oscillation. On the one hand, from the above chart, the yellow trend resistance line in the past few days has been broken, and the downward retracement confirms and stabilizes and continues to rise, indicating that the breakthrough is effective, it depends on whether the news can help tonight; on the other hand, the circular reference to the trend of the 18-19 is also a one-sided force after breaking through the downward trend resistance line, and the trends of the two are similar; finally, from the recent low point 3613 to the high point 3790, it is also moving a five-wave rise, and the current four-wave There are still signs of ending the callback. The fifth wave will rise. According to the proportion, it can reach the 3826 position; therefore, technically, it will continue to be bullish above 3743 tonight, which is nothing more than waiting for the PCE data. If the favorable force is large, it will help, take off directly on the spot, and quickly hit 3772-3780, and even hit a record high; if the bad news, then sweep the circle and then go above the low level of 3724-25 to wait for stability;

In terms of silver: silver has a relatively obvious strength, and it is all about sideways consolidation, and then it makes a new high, relying on the top and bottom support or the mid-line track of the hourly line; it closed strongly at the high overnight, with a big daily line, and a sharp drop first appeared in the morning today, so it is necessary to continue to dare to follow the trend, while the 44.6 line was in the mid-line track of the hourly line, and it was 618 againThe position, where you can stabilize and bottom out and rise, you can decisively follow the bullishness and successfully reach the overnight high of 45.2; currently, the middle rail support is being consolidated between 45.2 and 44.6, and the middle rail support is moving upward by 44.9. Either you directly attack above 44.9, or try to stabilize and attack by 44.6-44.5; or after breaking through 45.2, after standing up strongly, you can retrace and confirm that you will follow the bullishness, with a short-term target of 45.5-45.7;

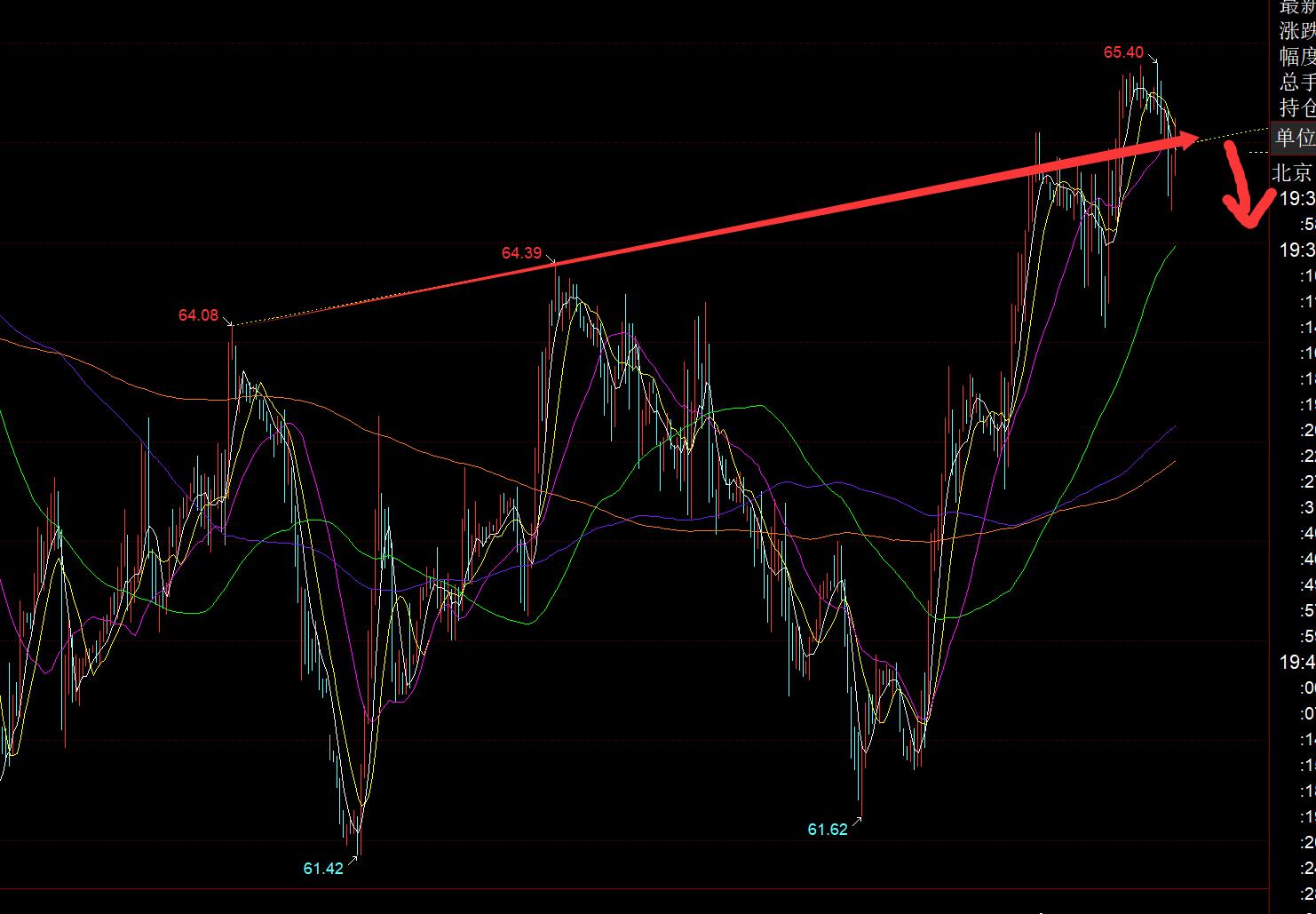

In terms of crude oil: The recent large fluctuation range of the daily line is 66-61. Before it goes out, there is still repeated fluctuation and movement. From the short cycle of the above figure, the trend resistance line mentioned yesterday suppressed a wave, but the space is not large, and it is only given to the 64.1 line; there is a surge and fall below this line. Pay attention to the gains and losses of 65. If you can't stand up, you must be careful to rise and fall. The hourly line macd also has a top divergence, and it is easy to fall back;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by more than 12 hours a day for more than 12 hours a day. It will be published every day. Open the technical point, cooperate with text and video interpretation, friends who want to learn can xmltrust.compare and reference based on actual trends; those who recognize ideas can refer to the operation, lead the defense well, risk control first; those who do not agree should just be over; thank everyone for their support and attention;

[The article views are for reference only, investment is risky, and you need to be cautious when entering the market, operate cautiously, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xmltrust.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Market Analysis]: As long as you dare to make a lot of profits tonight, gold prices will dare to rise straight up". It was carefully xmltrust.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here