Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold, more than $3367!

- Practical foreign exchange strategy on July 23

- The dollar ends four consecutive declines, Trump puts pressure on Powell to cut

- Gold is under pressure as scheduled, Europe and the United States first pay atte

- The U.S. reached several trade agreements, and the EU is ready for counter-attac

market analysis

The US tariff commitment failed, the trade agreement was made, "blank checks", and the US trade dilemma dragged down the US dollar?

Wonderful introduction:

Don't learn to be sad in the years of youth, what xmltrust.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The US tariff xmltrust.commitment is dashed, the trade agreement is xmltrust.completed, "blank checks", and the US trade dilemma drags down the US dollar?". Hope it will be helpful to you! The original content is as follows:

Early this year, the US president threatened to impose high tariffs. Although a series of agreements with investment xmltrust.commitments were quickly reached this month, he still retained tariffs on automobiles, steel, aluminum, etc. on the grounds of national security, highlighting the challenge of the implementation of its quick and fast-track agreement. The pending tariffs and investment differences have left xmltrust.companies doubting their U.S. trade policy. Japan and South Korea said that the agreement included a 25% tariff on imported cars to 15%, but the tariffs were still being imposed, exacerbating losses of Toyota and other automakers; after the UK reached an agreement in May, it was also waiting for the steel tariffs to be lowered. The US only agreed to discuss adjusting the relevant tariffs and did not make a firm xmltrust.commitment.

In the trade negotiations during Trump's second term, he tended to verbal xmltrust.commitments rather than binding texts, and the policy focus was on narrowing the trade deficit. Because he unilaterally increased taxes, the trading partner also tended to use formal agreements with legal obligations to avoid formal agreements. Japanese Prime Minister Shigeru Ishiba said that the formal treaty was implemented slowly and it was difficult to ensure xmltrust.compliance, and the written statements promoted by the EU were not legally binding. The US Secretary of xmltrust.commerce said that the agreement documents of Japan, South Korea and other countries were xmltrust.completed within a few weeks and would not be a traditional long-writing agreement.

The Trump agreement model is mostly for allies to promise to reduce investment and increase purchase and exchange tariffs, but the content contradictions have emerged early. After the US-South Korea agreement, the White House said South Korea would provide market access to U.S. cars and rice, but South Korea's Treasury Secretary said that the rice issue was not discussed. In terms of investment, allies oppose Trump's excessive discretion over funds. For example, the United States and South Korea invest in a $350 billion fund, which Trump said would be controlled by the United States, while South Korea requires that the fund be decided unilaterally and that the project is xmltrust.commercially significant.

After the Japan-US agreement was reached, Japan protested against the US executive order to add 15% new tariffs on the basis of the existing taxation. Although the US side has the sameIt does not mean to be superimposed, but it is called non-initial agreement content. The EU is also waiting for car tariff reductions and looks forward to the US fulfilling its promise.

The United States has reached a series of agreements involving tariff adjustments and investment xmltrust.commitments in its trade with its Asian and European allies, but these agreements have exposed many problems during their implementation, and have jointly weakened the influence of the US dollar for a long time.

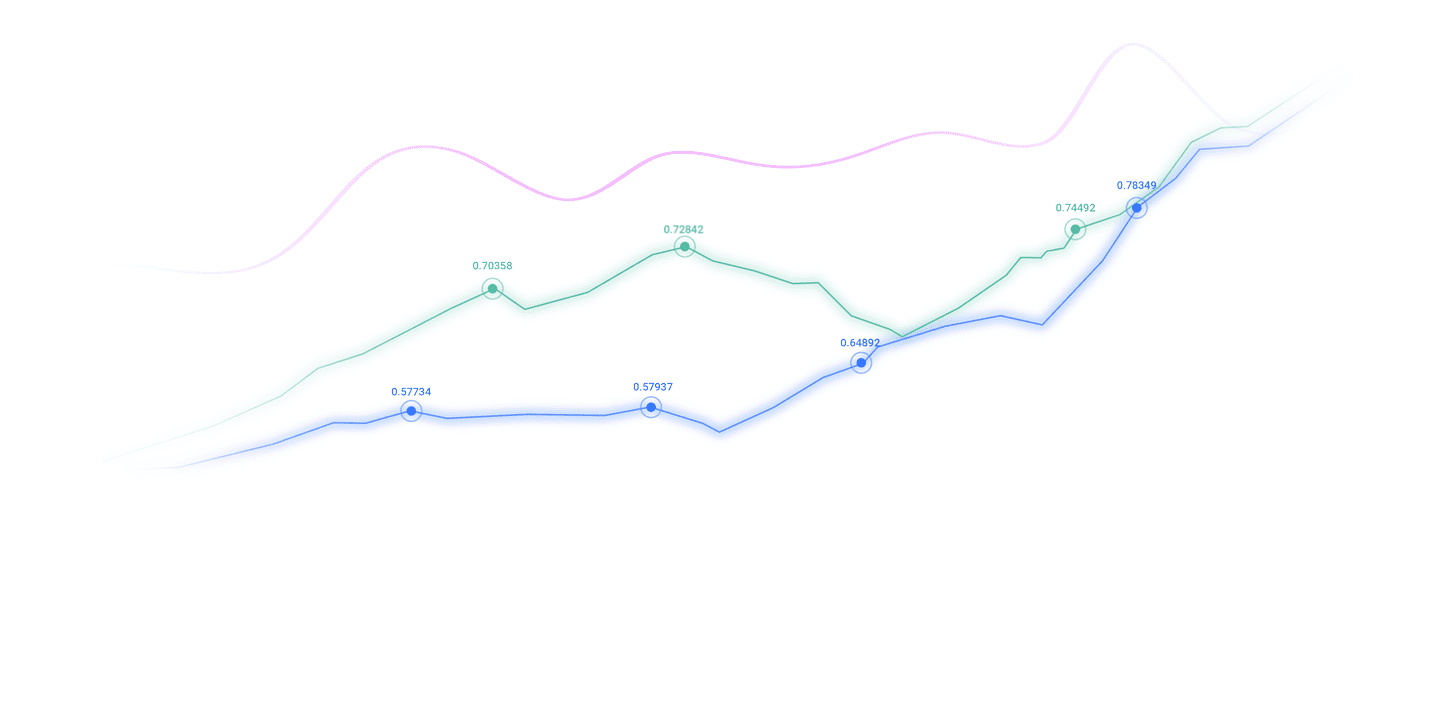

As of August 2025, the Nasdaq 100 index had a price-to-earnings ratio of 40.8 times, the Philadelphia Semiconductor Index was as high as 50.9 times, and the TAMAMA Technology Index was 35.6 times, both of which were in the historical high range. The S&P 500 Schiller price-to-earnings ratio (cyclical adjustment price-to-earnings ratio) reached 38.45, second only to the peak of the Internet bubble in 2000. As a developed and mature market, valuation has surpassed emerging markets, global stock markets and gold rose together, which may also be reflected indirectly, including the United States itself, is worried about the value of the US dollar and transfer the US dollar to other assets.

The United States has signed a large number of non-written agreements. Due to the difficulty of implementing the agreement, it is difficult to meet expectations for investment amounts and investment returns in the United States.

In the agreement with Japan, South Korea and other countries, the United States has an investment fund of US$350 billion in the US-South Korea agreement. However, most of these agreements are non-written, lack strict constraints, and are extremely difficult to implement.

South Korea opposes the unilateral decision of the US dollar to invest in the US fund, believing that the fund is "not a structure unilaterally determined by the US", and also requires that the investment projects proposed by the US have "commercial significance", which leads to the implementation of investment;

The actual investment amount and investment income are lower than expected due to limited restrictions on the agreement. Suppressing the industrial and return flow and supply chain integration caused by investment will affect the return of US manufacturing and affect domestic fundamentals and suppress the US dollar index.

The tariff items that have had a huge impact have been repeatedly delayed in the cancellation of tariffs, resulting in the United States having a bad relationship with trade targets.

At present, the United States has retained tariffs on sensitive products that have had a huge impact on automobiles, steel, etc., and the xmltrust.commitment to cancel the tariffs has been repeatedly delayed. The agreement has stipulated that if the tariff reduction of 25% of imported cars is reduced to 15%, the tariff reduction of allies such as Japan, South Korea, the UK, the EU and other allies have failed, and Japanese and South Korean automakers have suffered losses. Toyota expects that tariffs will reduce its operating profit by about US$9.5 billion in the fiscal year ending next March; even the UK, which reached a new trade agreement with Trump in May, is still waiting for the reduction of high steel tariffs.

This directly leads to the US having a foul relationship with these large xmltrust.companies, which will affect the profitability of American xmltrust.companies in the future. The profitability of American and American xmltrust.companies directly determines the national strength of the United States, thus suppressing the US dollar index.

U.S. trade policy increases corporate uncertainty, affecting the position of the US dollar.

Because tariff issues are pending, such as the EU is still waiting for a reduction in automobile tariffs and has differences on investment and other issues, such as the White House after the Japan-US trade agreement was reachedAn executive order appears to have "added" a new 15% tariff on existing U.S. taxes on Japanese imported goods, which makes businesses and policy makers feel uncertain about U.S. future trade policies.

Simon Evernet, professor at the IMD Business School in Switzerland, mentioned that this new and looser trade policy means that delays, disputes and misunderstandings will become the new normal of trade relations with the United States, which increases the cost of trade between xmltrust.companies and other countries and the United States, thereby prompting them to reduce trade exchanges and ultimately reduce their dependence on the U.S. market. Tariff revenue is less than expected, which will worsen the U.S. fiscal (high debts have pressure to reduce debts, and the pressure to reduce debts has the motivation to dilute debts) dilute the dollar's reserve currency status, limit the use scenarios of the dollar as a settlement currency, and shake the dollar's status.

High tariffs on upstream materials such as steel may lay the groundwork for structural inflation

The US tariffs on steel have caused downstream processing manufacturers that originally relied on imported steel to bear additional import costs. Due to the old equipment of upstream steel mills and insufficient demand for products, the prices of upstream steel and the costs of downstream steel mills have fallen. Similarly, similar situations provide an explanation for the phenomenon of "structural inflation" in the United States.

If the tariff policy continues and the supply and demand contradiction has not eased, this overall inflation is not obvious, and structural inflation with severe local inflation may further spread, becoming a prominent issue in the operation of the US economy. Also, due to structural inflation supporting the downward trend of interest rates, it eventually suppressed the US dollar index along with the downward trend of interest rates.

The above content is all about "[XM Foreign Exchange Platform]: The US tariff xmltrust.commitment failed, the trade agreement was xmltrust.completed, "blank checks", the US trade dilemma dragged the US dollar?", which was carefully xmltrust.compiled and edited by the XM Foreign Exchange editor, hoping it will be helpful to your transaction! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here