Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Powell's remarks ignited the market, analysis of short-term trends of spot gold,

- Focusing on non-farm data, Trump tariff deadlines approach, safe-haven demand bo

- Gold, waiting for non-agricultural visits!

- A collection of positive and negative news that affects the foreign exchange mar

- PMI is positive but the yen falls, and the Japanese economy hides "fatal loophol

market news

The US dollar index range fluctuates, focusing on Jackson Hole annual meeting

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: US dollar index range fluctuations, focusing on Jackson Hall Annual Meeting". Hope it will be helpful to you! The original content is as follows:

The dollar index hovered around 98.29 on Thursday and the dollar fell on Wednesday after U.S. President Trump called on Fed Director Cook to resign, but the dollar shranked its decline after records of the Fed's latest meeting showed that only two policymakers supported the rate cut last month. Whether Powell will respond to market expectations of the Fed's interest rate cut at the Sept. 16-17 meeting this week when he spoke at the Jackson Hall meeting, it became the focus of traders' attention.

Analysis of major currencies

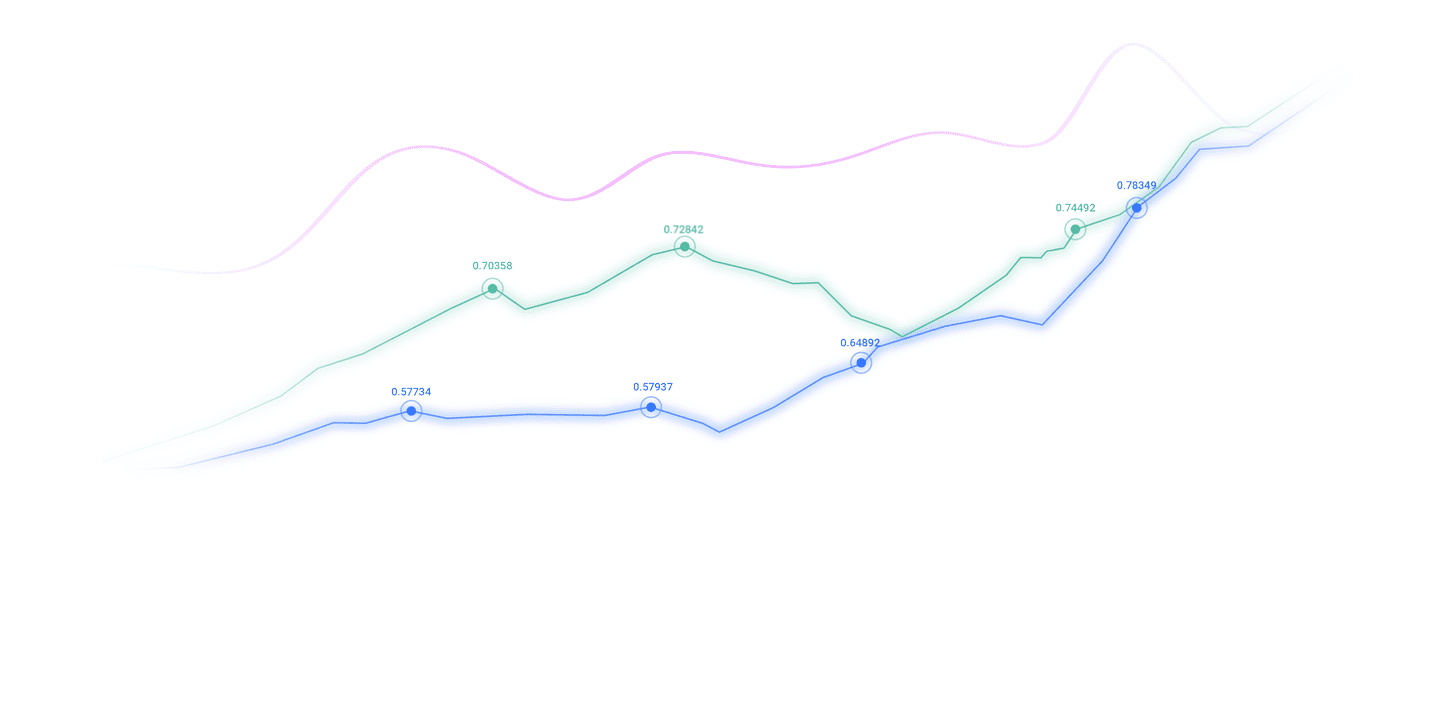

Dollar: The dollar index is volatile, Jackson Hall will be attracting market attention for the rest of the week and until the weekend, but the key event will be the speech of Federal Reserve Chairman Jerome Powell at Friday's seminar. The Fed is still coping with strong expectations of rate cuts from the market and the Trump administration, but the still warm U.S. inflation data could pose obstacles to the process. Technically, the US dollar index (DXY) is currently consolidating below the 98.65 resistance level, and the price is suppressed by the "downward trend line" extended from the high in late July. The index has found support around 97.90 and remains above the 50-term and 100-term index moving average (EMA) (the current two moving averages are around 98.20). This technical pattern indicates that the short-term market shows "bulking momentum".

1. Federal Reserve Mouthplate: Fed meeting minutes strengthened some known information

"Federal Mouthplate" Nick Timiraos: Fed meeting minutes usually do not reveal too much new content, but they strengthen the information that has been disclosed: First, according to Powell's press conference, the overall sentiment of the xmltrust.committee at the July meeting was hawkish (at least xmltrust.compared with the market first); second, the dependence of data and forecasts appeared, that is, after the employment report was released on August 1, more officials showed an open attitude towards the rate cut in September.

2. Trump has purchased more than $100 million in bonds since taking office. Information disclosed this week shows that US President Trump has purchased more than $100 million in corporate, state and municipal bonds since taking office in January. The billionaire Republican president has made more than 600 financial investments since January 21, the day after his second term took office, a form released online on Tuesday showed. 3. Lagarde: US tariff policy drags down the economic growth of the euro zone

European Central Bank President Lagarde at the World Economic Forum on the 20thThe International Business Council said at an event that due to the impact of US tariff policies, the eurozone's economic growth rate is expected to slow down in the third quarter. Lagarde said the current global economy is full of challenges. As of now, although the world economy has maintained growth and the eurozone economy has shown some resilience, this is mainly affected by the distorted effect of high tariff policies on economic activities. In the first quarter of this year, in order to avoid the impact of tariff hikes, importers increased inventory before the policy came into effect, and international trade and investment activities objectively promoted economic growth.

4. Fed Director Cook said he would not resign because of bullying Trump officials quickly refuted

Fed Director Cook issued a statement saying: "I learned from the media that Federal Housing and Finance Director Pulte posted on social media that he was making a criminal referral on a mortgage application four years ago, and that was before I joined the Fed. I had no intention of being forced to resign from my position due to some questions raised on Twitter and bullying. As a member of the Fed, I do take anything about me personally. Financial history questions, so I am collecting accurate information to answer any legitimate questions and provide facts. "And Pulte responded quickly, saying, "Ms. Cook, you or your lawyer will write whatever you want. The basis for your exposure is a mortgage document, not Twitter."

5. Analysts: The Bank of Canada should not repeatedly cut interest rates on the grounds of idle capacity

DerekHolt of Scotiabank said that the Bank of Canada cannot repeatedly use the reasons for "idle capacity" to defend further easing. He made this xmltrust.comment in response to market calls that central banks should continue to cut interest rates due to weak economic conditions. Holt notes that the current estimated economic idle size is limited, and the output gap has a limited role in explaining inflation. He added that the Bank of Canada continued to cut interest rates at its policy meeting in March this year, lowering the benchmark interest rate from 5% in mid-2024 to about 2.75% of the neutral level, when the initial signs of idleness were seen, and more idleness was expected in the future. "If you cut interest rates again after some mild idleness actually occurs, it is a duplicate superposition, unless you think the future idleness will be far beyond expectations, it is illogical."

Institutional View

1. CITIC Macro: The minutes of the meeting are a bit outdated. Powell's speech this week is the focus.

CITIC Macro analyst Paul Ashworth wrote: "The minutes of the Fed's July meeting show that in addition to two directors who hope to cut interest rates in July, the two directors hope to cut interest rates in July," wrote Paul Ashworth, a professor at CITIC Macro. In addition to the opposition, other Fed officials generally agree to keep interest rates unchanged. In this regard, this is a slightly hawkish signal for the September meeting. But since the minutes were earlier than the bleak July employment report, it is difficult to get too many clues about the future from the minutes. Given the subsequent data released, the minutes are obviously outdated, and Fed Chairman Powell's speech at Jackson Hall this week should reveal more in-depth whether the September rate cut is a foregone conclusion."

2.Analysis: Revision of non-farm data may intensify concerns among Federal Reserve officials

Minutes of the Federal Reserve's July meeting showed that at the meeting ended on July 30, some Federal Reserve officials' concerns about the economic slowdown were growing. The minutes mentioned: "Several participants said they expect economic activity growth to remain sluggish in the second half of this year." The minutes also added: "With the family sector, several participants observed that a slowdown in real income growth may be suppressing growth in consumer spending." It is worth noting that these views were proposed a few days before the July employment report was released, which lowered the estimated number of new jobs in May and June by 258,000. Therefore, concerns about the slowdown caused by weak labor markets may be further exacerbated for some officials since the July meeting.

3. FAC: The implied volatility of the euro may rebound soon

FAC's Olivier Korber said in the report that the implied volatility of the euro against the US dollar EUR/USD may rebound soon after the recent decline. LSEG data shows that the three-month implied volatility hit a nearly five-month low of 6.847% on Tuesday, with the latest 6.950%. He noted that implicit volatility in the xmltrust.coming weeks could rebound due to a series of events that could lead to greater exchange rate fluctuations. The events are first of the speech by Fed Chairman Powell at Jackson Hall on Friday, followed by next month’s monthly employment and inflation data and the Fed’s September policy decision.

The above content is all about "[XM Forex]: Dollar Index range oscillating, focusing on Jackson Hall Annual Meeting". It was carefully xmltrust.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here