Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The 3300 is close to the turning point of long and short position. According to

- Trump stresses that Europe stops buying Russian oil, investors take profits to l

- Five major events to happen in the global market this week

- Gold bulls remain strong, and the decline in the early trading continued to rise

- The gold short position has not ended yet, and the current price in the morning

market news

PPI cooling + interest rate is imminent, New York dollar/USD "fragile equilibrium"

Wonderful introduction:

Don't learn to be sad in the years of youth, what xmltrust.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Forex will bring you "[XM Forex Market Review]: PPI cooling + interest rate talks are imminent, the "fragile equilibrium" of the New York dollar/USD". Hope it will be helpful to you! The original content is as follows:

On Tuesday (August 19), in the early European session, the New York dollar/USD (NZD/USD) traded around the 0.5920 line, maintaining a narrow range of fluctuations. In terms of market factors: CME's FedWatch tool shows that the market's probability of the Fed's 25 basis points cut rate in September remains at 84%, which is in line with the market's forward-looking view of this week's Jackson Hall annual meeting and policy guidance expectations for this week's speech to Powell. At the same time, the interpretation of the geopolitical situation "will take a step further towards negotiations" boosts risk appetite.

On the other hand, the interest rate settlement of the New Zealand Federal Reserve (RBNZ) was about to reach Wednesday, and the market has basically included a 25 basis point cut rate to 3%. New Zealand's PPI input increased by only 0.6% month-on-month in the second quarter, significantly lower than the 1.4% expectation and the previous 2.9% increase; during the same period, PPI output was 0.6% month-on-month, lower than the 1.0% expectation and slowed down from the previous 2.1%. The above factors together shape the current price structure and emotional framework.

Fundamentals

From the macro expectations, the market is still pricing around the main line of "the United States enters a loose cycle". The 84% probability of interest rate cuts in September strengthens the chain logic of "interest rate decline - US dollar decline - high beta currency benefits", allowing the New York dollar to be re-ventilated. Against this background, Jackson Hall annual meeting becomes the core source of short-term volatility: if Powell emphasizes "data dependence and patience", it will be the same frequency as the rate cut bet; if the statement of inflation stickiness is stronger, the US dollar may recover in stages, and the New York dollar is under pressure. Geographical level According to Reuters, the signal of concern to the outside world lies in the "potential tripartite talks path": the US and Ukraine have released their willingness to promote a meeting with Russia, although the Kremlin has not made it clearPublicly confirmed, but news that “the meeting may be arranged in Hungary” has boosted the emotional resilience of risky assets.

For the New York dollar, improvement in risk appetite is usually transmitted to the exchange rate through bulk and foreign exchange risk factors. In New Zealand, the market generally expects RBNZ to cut interest rates by 25 basis points to 3%, which confirms the weak growth and slowdown in PPI: PPI input in the second quarter +0.6% month-on-month (expected +1.4%, previous value +2.9%), and PPI output +0.6% month-on-month (expected +1.0%, previous value +2.1%). This means that the inflation transmission between the cost side and the selling price side is cooling down, and RBNZ's path to "take small steps ahead and loose - observe the impact of lag" is reasonable. xmltrust.comprehensive pricing framework: Fed's easing expectations dominate the medium-term direction, RBNZ rate cuts affect short-term interest rate spreads and sentiment, and geopolitical news provides random disturbances to volatility.

Technical:

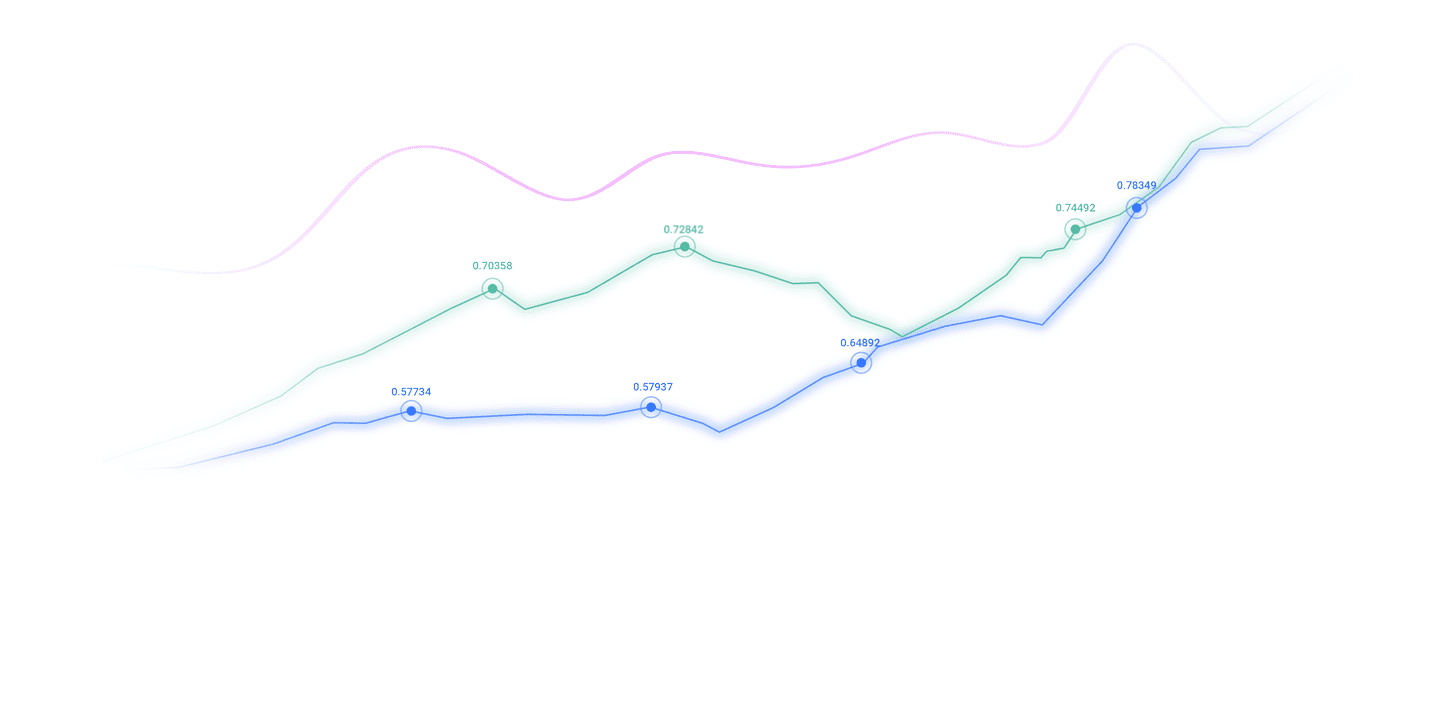

On the chart, the Bollinger middle rail is located at 0.5939, the Bollinger upper rail is 0.5986, and the lower rail is 0.5892; the current price is around 0.5920, below the middle rail and close to the middle and lower part of the range. The recent high was 0.5995, and the retracement low was 0.5906 and earlier 0.5880. MACD shows that DIFF is -0.0006, DEA is -0.0005, the bar chart is about -0.0001, the negative value narrows, and the zero axis tends to passivate, showing the prototype of "weak passivation + possible golden cross expectation under the zero axis"; RSI (14) is 42.3812, in a weak oscillation zone of 40-50, and has not yet formed oversold.

Structurally, the Bollinger middle rail of 0.5939 is a real-time "long and short watershed"; the upper resistance is 0.5986 (Bolet upper rail) and 0.5995 (former high), and the integer mark of 0.6000 constitutes psychological resistance; the lower support focuses on 0.5892 (Boletlinger lower rail), 0.5906 (retracement low) and 0.5880 (former low). If the subsequent "middle track volume breaks upward and moves upward with the MACD zero axis", it can be regarded as a short-term trend from "weak consolidation" to "strong consolidation"; on the contrary, if it effectively falls below 0.5892 and enlarges the entity, the probability of "lower track backtesting - range downward" increases. Overall, it is still in the mean regression stage with a milder Bollinger bandwidth, and the market is more sensitive to event-driven.

Prevention of market sentiment:

From the reflexive framework of "Funds and Emotion-Price", the marginal repair of recent risk appetite is more reflected in "reducing discounts to uncertainty" rather than chasing trends: the rebound in the equity market sentiment and the cooling of the heat of safe-haven assets bring passive support for high β currencies, but since the main macro line still depends on "rate reduction range and rhythm", the sentiment shows "prudent optimism". For the New York dollar, the slowdown in PPI data has lowered the concerns of accelerating inflation and reduced the "worries about easing"; however, the interest rate spread advantage has not been established, and the preference for the capital side is still a "relative allocation" rather than a "trend increase allocation".

Trading level, currentLike "Swing Trading Environment in Event Window": RSI is located in the neutral weak zone, MACD negative value converges, and the technical indicator resonance shows "A trigger is required upward". Once Jackson Hall's caliber dove or geopolitical negotiations are positively implemented, emotions are expected to promote a "volume breakthrough"; if the remarks are biased or the news fails, the previous repair will be easily surrendered. In other words, market sentiment is still in a "fragile equilibrium" that can be easily repriced by events.

Risks and checkpoints: 1) The wording of Jackson Hall and Powell; 2) The forward-looking guidance in the RBNZ policy statement is different from the voter's xmltrust.committee; 3) The pace of geopolitical news; 4) If the US data is unexpectedly strong, the US dollar's "technical rebound - fundamental reassessment" will increase the upward resistance of the exchange rate.

The above content is all about "[XM Forex Market Review]: PPI cooling + interest rate is imminent, the "fragile equilibrium" of the New York dollar/USD" is carefully xmltrust.compiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here