Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Golden Retriever is looking forward to lower interest rates, gold and silver ham

- Is gold really going to fall again?

- The United States and Japan join forces with VS the EU, the countdown to "nuclea

- Continue to go down, 3359 is the key to long and short!

- The USD/JPY is hesitant around 148.60, both the USD and JPY are on defensive

market news

In the most uneasy week in August, can a set of data be exchanged for two interest rate cuts?

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Forex Official Website]: In the most uneasy week in August, can a set of data be exchanged for two interest rate cuts and pricing?" Hope it will be helpful to you! The original content is as follows:

Summer liquidity narrows, but macro triggers will remain dense next week. Market pricing will revolve around the framework of "data priority - central bank assistance - geopolitical disturbance".

The key releases from Monday to Friday are: pay attention to Norway's July CPI and second-quarter GDP on Monday; Tuesday welcomes the RBA interest rate resolution, UK employment in June, Germany's August ZEW indicator, Canada's June construction permit, and the highlight - the US July CPI; Wednesday's July corporate prices (CGPI); Thursday's most crowded, Australia's July employment, UK's June and second-quarter GDP, Sweden's July CPI, Norwegian central bank interest rate resolution, eurozone's second-quarter correction GDP and June industrial output parallel, the United States announced the initial request for July PPI for the week; Friday's finale of Japan's second-quarter GDP, US July retail sales, Canadian manufacturing shipments, and US July industrial output and Michigan's early August value. The weekly rhythm formed by this determines the repricing path of the US dollar and G10 interest rates around inflation and growth clues.

The main line of the US dollar: the rebalancing of inflation readings and employment cracks

In terms of macro background, the US July employment report was unexpectedly weak: non-agricultural sectors were significantly lower than expected, the unemployment rate rose, and a total of 258,000 people were downgraded from May to June, indicating that the employment momentum was lower than previous perceptions. At the same time, the ISM non-manufacturing PMI fell in July, and the manufacturing industry remained weak, and the growth prospects were squeezed. This xmltrust.combination forces the market to re-examine the relative weights of "inflation stickiness" and "demand slowdown".

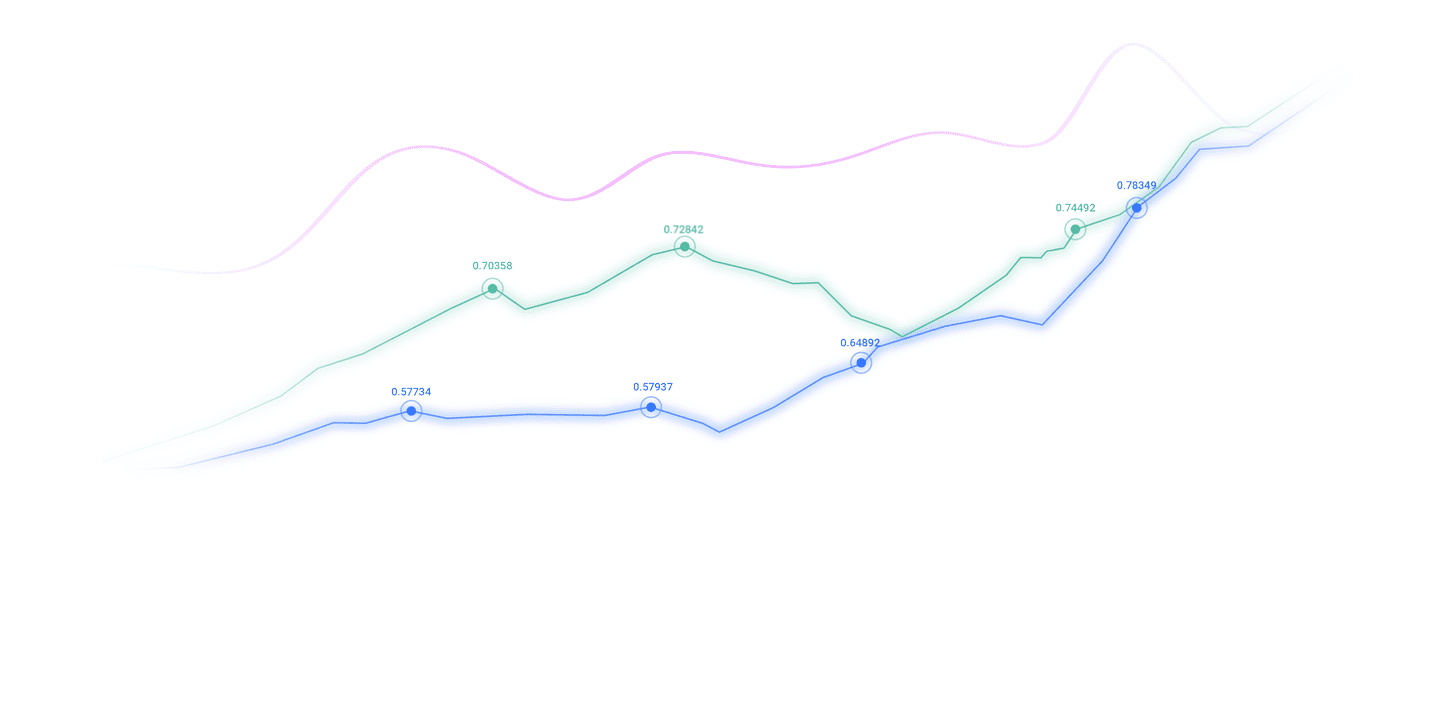

The meaning of transactions lies in the chain revaluation of "CPI/PPI → nominal and actual interest rate → USD". If CPI accelerates and is PPI in JulyIt proves that cost-driven and tariff transmission will raise nominal interest rates and break-even inflation, suppressing the duration of US Treasury bonds and being favorable to the US dollar in stages; if inflation weakens, employment cracks will dominate the narrative, and the expectation of deflation will rise again and the US dollar is under pressure. Retail and industrial output on Friday will test demand resilience: if retail accelerates, it can hedge growth concerns and provide late-market support for the US dollar; if it weakens, the repricing of "weak growth + slow inflation" will be strengthened, and the US dollar faces pullback pressure.

Federal context: pigeon pricing and personnel variables

After non-agricultural farms in July, some officials (such as Daly and Kashkari) have become more moderate in wording, and the market has also quickly shifted from "standard in the year" to repricing of "two rate cuts" before December. Analysts believe that if subsequent xmltrust.communication continues to show dovish tendencies, the US dollar will be temporarily suppressed. However, it should be noted that inflation is still an extremely sensitive variable for the decision-making level. As long as CPI/PPI becomes sticky again, the interest rate cut path will be postponed or reduced at any time.

In addition, the rise of personnel uncertainty has become a new source of risk premiums. Discussions about the succession of the chairman are heating up, and Waller is frequently named; at the same time, Stephen Miran is nominated to fill the Kugler vacancy. If approved by the Senate, it will be regarded as a dove voice and may change the balance of power within the FOMC. Such personnel progress does not directly change the short-term curve, but can affect the medium-term risk premium of the US dollar through the expected channel.

Tariffs and Geographical: The "third hand" of pricing

In addition to fundamentals, tariffs and geographicality are still at the left and right ends. The recent horizontal spread of industry tariffs (such as the proposed 100% tariff on semiconductor imports, and medicine may be the potential next target) have increased the tail risk of cost-driven inflation and also increased the risk premium. If substantial progress is made in negotiations around Russia, the premium of energy and geopolitical risks will decline, and the fundamental level will be more favorable to the US dollar; on the contrary, the expansion of tariffs will create greater fluctuations and increase the time-point risk of trading direction through the "cost-inflation-interest rate" chain. Reuters also mentioned that the CPI has received special attention after the personnel adjustment of statistical agencies, and the market will closely examine its impact on pricing, which further amplifies the impact of data on the US dollar.

G10 Central Bank Differentiation: "Expected Difference" between RBA and Norway

In this round of easing cycle, Australia and Norway are relatively cautious: RBA has only cut interest rates by 25bp twice since its peak, and Norway has only dropped by 25bp once. The current market is inclined to see the RBA drop by another 25bp on Tuesday, while Norway remained on Thursday, or postponed to November again. Analysis reminds that the last time the two central banks were opposite to market pricing, and the "face-slapping risk" cannot be ignored.

Seasonality and fluctuations: Don't be confused by "calmness"

The volatility in August has been high in history. Reuters statistics show that the average daily percentage fluctuation of VIX in August in the past 35 years was the first in each month, while the lowest in April was only 0.07%. xmltrust.combined with the current dollar position being stretched and macro uncertainty is concentrated in several highly sensitive data windows, any inflation or policy title may triggerExceeded fluctuations. At the strategic level, shorten the duration before the event and reduce leverage. In the event, options are managed to jump risks. After the event, add and subtract based on the direction of interest rate end and the trend of the US dollar to improve capital efficiency and drawdown control quality.

Operational framework and scenario xmltrust.combination

In the "inflation is reaccelerated" (CPI and PPI both rise) scenario, nominal and real interest rates rise, and the probability of a dollar strengthening rises; if "inflation is moderate and growth is weak" (CPI/PPI slows down and retail is soft), the expectation of interest rate cuts is consolidated, the US dollar is under pressure and the curve is more likely to be steep, and gold and medium- and long-term interest rate-sensitive assets are more popular. If geopolitical favorability and negotiation progress appear simultaneously, risk preferences will rebound, and the cycle and xmltrust.commodity currency will be relatively dominant; on the contrary, if geopolitical repeatedly overlap with tariff expansion, risk assets are under pressure, inflation is upward, policy dilemma, and volatility will rise, the direction of the US dollar will depend on which growth or inflation, and the risk aversion preference of funds.

Therefore, the key points of this week's trading should be around the three axes of Tuesday CPI and Thursday PPI/First Request, Friday retail/industrial output/Michigan, and dynamically adjust the direction and exposure of the US dollar and front-end interest rates; the pound and the euro can choose through the "relative value" window of British GDP and euro zone GDP correction/industrial output; in terms of the yen, pay attention to the disturbance of the narrative of the interest rate spread between CGPI and Japan on Friday; the Australian dollar and Norwegian kroner are mainly based on the option-based expression of "central bank differentiation + expected difference".

Conclusion:

Next week is a typical week where the three lines of "data × central bank × geopolitical" are intertwined. For professional traders, the key is not to bet on a single point, but to build a repeatable position management and risk control mechanism around key nodes: reduce leverage before the event, use options in the event, and follow the trend after the event. As long as the inflation path and employment cracks are kept synchronously, and the central bank's xmltrust.communication and personnel variables are included in the risk premium assessment, there is a rule to price the US dollar and interest rates, and the strategy implementation is more noise-resistant.

The above content is all about "[XM Forex Official Website]: In the most uneasy week in August, can a set of data be exchanged for two interest rate cuts?", which was carefully xmltrust.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here